Professional Skepticism: A Model for Public Sector Auditing

by Dr. Hamid Reza Ganji, Assistant Professor, Department of Accounting, Alzahra University, and Dr. Ghorban Eskandari, Senior Auditor, Supreme Audit Court of Iran

Professional skepticism is a key element in high-quality audits, as it ensures auditor judgments are less clouded by personal biases. According to audit standards, professional skepticism involves having a questioning mind and critically assessing audit evidence. However, there is no universally accepted definition of professional skepticism. As a result, the ways in which auditors exercise professional skepticism vary.

Recent discussions in the auditing community have identified two primary approaches to professional skepticism: “neutrality,” in which the auditor neither assumes management is dishonest nor unquestioningly assumes honesty, and “presumptive doubt,” in which the auditor assumes some level of carelessness, incompetence or dishonesty on the part of financial statement preparers unless the evidence shows otherwise. There is a lack of consensus on which of these two approaches is most appropriate for auditing.

A Study to Determine a Model for Professional Skepticism

Regulatory bodies, standard setters and academic researchers have recognized the need to better define what constitutes professional skepticism and develop a model for how auditors can apply it. To that end, this study examined how auditors in Iran define professional skepticism, how they exercise it when interacting with different clients, and how audit entities can better emphasize the importance of professional skepticism.

Previous studies have provided conceptual frameworks for understanding professional skepticism by reviewing audit standards and testing relationships between professional skepticism and other variables. This study contributes to the discussion by basing conclusions about professional skepticism on how it is actually exercised by Iranian auditors and audit firms.

Research Methodology

The research used a grounded theory approach involving systematic data gathering and analysis for theory development. Twenty-eight semi-structured interviews were conducted with independent auditors holding positions at various organizational levels, such as managers, supervisors and senior auditors.

Participants (members of the Iranian Association of Certified Public Accountants and the Supreme Audit Court of Iran)were selected using the snowball sampling method, where participants helped recruit other participants. Members were asked several questions related to professional skepticism, including concept definition, exercising it in specific situations, and the conditions considered necessary to support its use.

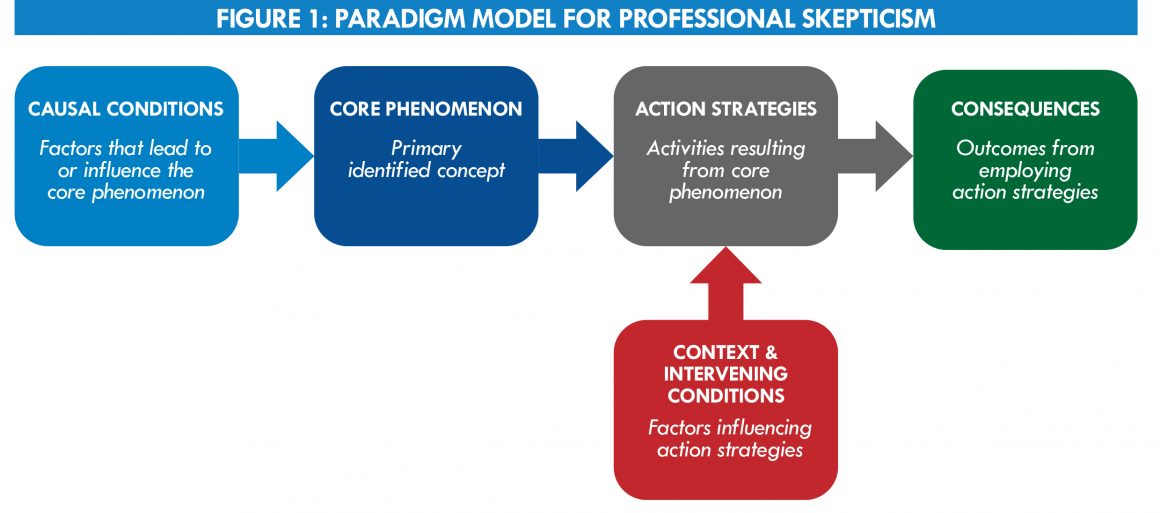

Based on collected and analyzed interview data, a paradigm model was devised to identify concepts and interrelationships in a framework with one core phenomenon (see Figure 1). To measure interview validity and reliability, members of the study and subject matter experts were asked to review the methodology, model and overall findings.

Study Findings

Data showed “presumptive doubt” as the most common manner in which Iranian auditors exercised professional skepticism. Findings also demonstrated:

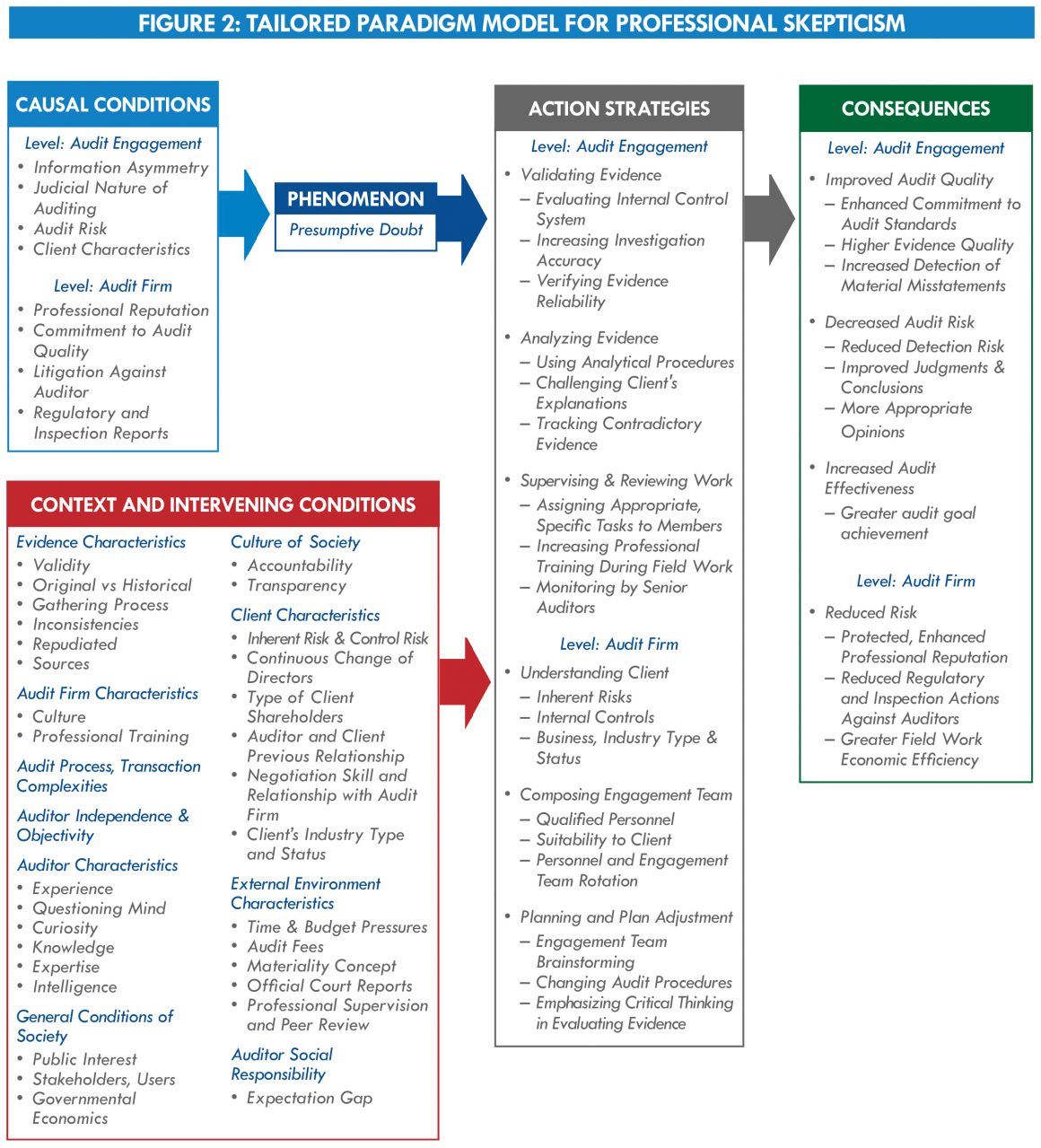

- Factors leading auditors or audit firms to have an attitude of presumptive doubt toward a client include information asymmetry, level of audit risk and client characteristics.

- An attitude of presumptive doubt can persuade auditors or audit firms to employ strategies, such as supervising and reviewing work; ensuring the engagement team is staffed with qualified auditors who are well suited to the client; validating evidence; challenging client explanations; tracking contradictory evidence; and adjusting plans as necessary.

- Strategies auditors or audit firms choose are influenced by many factors, including audit process complexity; level of auditor independence and objectivity; and characteristics of the auditor, client, evidence, and external environment.

- Employing these strategies has resulted in improving audit quality, increasing efficiency, protecting and enhancing an audit firm’s professional reputation, and reducing risks to auditors and audit firms.

Figure 2 is a paradigm model for professional skepticism that details the causal conditions; core phenomenon; context and intervening conditions; action strategies; and consequences tailored to the study data. It also provides a comprehensive list of identified context and intervening condition characteristics influencing action strategies auditors and audit firms may use when exercising professional skepticism. Some items identified through the interviews have not been emphasized in previous studies, such as information asymmetry, professional reputation, process of gathering evidence, materiality level, and shareholder type.

Supreme Audit Institutions in other countries may find it useful to incorporate the paradigm model into efforts aimed at strengthening professional skepticism. SAIs can customize characteristics to a particular context or use the findings as a case study in professional training modules.

For details about this study, the paradigm model, and a full list of references, contact the author at h.ganji@alzahra.ac.ir.