Using Integrity, Fraud Management Publications to Increase Transparency

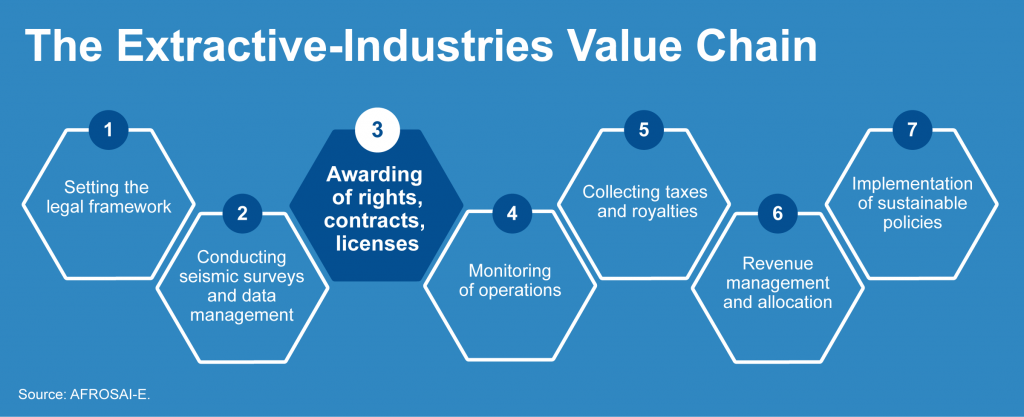

New resources are now available that Supreme Audit Institutions (SAIs) may find helpful when conducting audits using the extractive industries value chain, which describes the development process from discovery through extraction to lasting value creation for society.

An important step in the value chain process is awarding contracts and licenses, and the World Bank’s “License to Drill: A Manual on Integrity Due Diligence for Licensing in Extractive Sectors” (Manual) is a toolkit that specifically addresses this step. The Manual outlines recognized concepts, good practices and efficient options for policymakers and practitioners seeking to implement or improve integrity screening systems in extractive sectors.

The Manual’s introduction underscores existing widespread agreement that regulatory governance systems lack transparency and possess weak oversight and enforcement institutions, which facilitate an environment where rent-seeking and corruption thrive.

Ms. Cari Votava, World Bank Senior Financial Sector Specialist, who co-authored the Manual, describes it as a resource to improve quality and transparency in integrity due-diligence components of the extractive sector regulatory governance.

“Although there are many points in the extractive industries value chain where corruption vulnerabilities can emerge, licensing decisions are perhaps the most critical,” she explained.

Ms. Votava also noted that few countries can benefit when unsavory persons are granted licenses to operate in extractive sectors.

An overarching goal of the Manual is to identify good-practice options for reducing corruption risks in extractive industries by outlining methods to improve the licensing process—to maximize the quality of entrants and to improve transparency at an early stage in the value chain.

Before extractive licenses are granted or renewed, it is important to know the potential recipient, including the beneficial owner or natural person who ultimately owns (or controls) a legal entity or benefits from the entity’s assets.

An effective and transparent licensing process can (1) filter out many parties who might not act responsibly, and (2) have a positive impact on economic returns.

Specifically, the Manual offers options for implementing effective and low-cost integrity-screening systems, such as:

- Criminal-background checks;

- Beneficial-ownership checks; and

- Conflict-of-interest checks.

International frameworks provide potential criteria for SAIs to use when reviewing issues related to the extractive sector value chain.

For example, the Manual uses the “fit and proper” concept from “Licensing of the Basel Core Principles for Effective Banking Supervision” Principle #5 as criteria for ways to improve the quality of entities entering the extractive sector. The fit and proper principle requires systemic and thorough integrity background checks on banking-license applicants, including documenting beneficial owners’ identities seeking bank charters.

The Manual also uses Extractive Industries Transparencies Initiative (EITI) requirement #2 as a standard. This requirement obligates countries to publicly disclose information, including the identity of beneficial owners. According to the Manual, beneficial ownership disclosure requires identification and identification verification—both best done prior to granting licenses.

An additional framework potentially useful to SAIs when considering corruption-related fraud risks during contract and license award phases is the U.S. Government Accountability Office’s (GAO) “A Framework for Managing Fraud in Federal Programs,” also known as the Fraud Risk Framework.

The Fraud Risk Framework was issued in July 2015 and identifies leading practices in an effort to help program managers combat financial and nonfinancial fraud. It also provides criteria for SAIs in conducting program audits.

Emphasizing the need to plan regular fraud risk assessments and assess risks to determine a fraud risk profile, the Fraud Risk Framework also stresses that entities should design and implement a strategy with specific control activities to mitigate assessed fraud risks and collaborate to assist in effective implementation.

The Fraud Risk Framework directs managers to evaluate outcomes using a risk-based approach and adapt activities to improve fraud risk management.

For a full list of references or to learn more about these publications and how they can help SAIs in conducting audits, contact Johana Ayers at ayersj@gao.gov. For additional information on the extractive industries value chain contact AFROSAI-E and the INTOSAI Working Group on Audit of Extractive Industries.