Overview of the different models of SAIs and focus on the jurisdictional model

By Gilles Miller, Senior auditor and liaison officer of the Forum of jurisdictional SAIs at the French Cour des comptes

Introduction

There are three main models of SAIs in the world, and several variants. They have a very long history, dating back in some cases to the Middle Ages, but all three were renewed and developed between the 18th century and the beginning of the following century, when modern states were established.

- Westminster, or Parliamentary Model: Based on the model developed in the shadow of the Westminster Parliament, an independent agency attached to Parliament audits government accounts and evaluates public policy on behalf of the legislature. Born in the United Kingdom, this model is now widely used in all countries with a British or Anglo-Saxon culture, including the United States and in Scandinavian countries.

- Board or Collegiate Model: In Germany, from where it has spread to Central and Eastern Europe, a model has developed of courts of audit operating on the basis of a collegiate organization, but without jurisdictional powers.

- Judicial or Napoleonic Model: Lastly, some fifty countries have a SAI, which acts as both auditor and judge. SAIs with a judicial function, having shaped its collegial decision-making process, its status as an equidistant body between Parliament and Government, and its culture of evidence and adversarial proceedings, underpins respect for the rights of the defense. If France once provided the design, this model has spread to the entire Mediterranean region, as far as the Middle East, as well as to all French- and Portuguese-speaking nations, including Brazil and many Spanish-speaking countries.

Focus on the Judicial Model

The Judicial or Napoleonic model is an attractive model for SAIs: several countries that have adopted the “Westminster model” have recently equipped their SAIs with a new competence and an appropriate organization to sanction the misuse of public money. This is the case in the Republic of South Africa, Thailand and Latvia, and the list goes on… In Spanish-speaking Latin America, several “audit offices” or contralorias combine a jurisdiction (inherited from the Spanish Tribunal de cuentas) with an organization based on the Anglo-Saxon model.

But what exactly do these SAIs judge?

In detail, their responsibilities vary from country to country, but they all share a common origin and, above all, the same purpose: the accountability of all public managers for the consequences of their management.

It is safe to say that judicial control of public accounts was established with the dual birth of the State and the Treasury.

Originally, several centuries ago, the main aim was to ensure that public officials, who were responsible for collecting revenue and executing expenditure, could justify all transactions recorded in their accounts. Because such verifications required special knowledge and expertise, an institution was very soon established to specialize in control techniques. As an account is very much like “a trial between the one who renders it and the one to whom it is rendered”, as Jean-Jacques Régis de Cambacéres put it when he explained the advantages of a jurisdictional audit office to Napoleon I in 1807, the rendering of accounts very soon took on a jurisdictional form.

This initial model of administration and governance became a model to be emulated and was exported around the world. With a strict separation between the functions of authorizing officer or public manager and those of accountant or cashier required to submit annual accounts to an auditor, it is still widely used, but has evolved considerably.

The focus of the courts’ jurisdictional activity has shifted (at varying speeds depending on the country’s national legislation and the degree of maturity of national public accounting systems), towards the accountability of managers. Managers are now seen as the main players in public management, while public accountants are, de facto if not de jure, seen as subsidiary. In many countries, the two systems of responsibility (managers on the one hand, and public accountants on the other) coexist. A few countries have unified the two into a single accountability system (Portugal was one of the first, in 1971). Countries that have recently introduced a jurisdictional liability system (e.g. South Africa and Latvia), on the other hand, immediately designed a system targeting public managers.

The volume of court rulings depends on a number of factors: the size of the country and the number of people potentially concerned, the maturity of the system, the definition of offences, the policy followed by the prosecuting authorities, etc. Most often, the number of rulings is in the dozens, but some SAIs, such as the Corte dei conti in Italy, issue several hundred rulings, and even several thousand for the Tribunal de contas in Brazil. In any case, this is not a marginal activity.

However, jurisdictional organization and procedural rules differ widely from one country to another. Here are a few examples.

- In one example, the aim is for remedial action. The manager will be condemned, not for their wrongful conduct, but for the damage they have caused, which they will have to compensate. In this case, the SAI will operate on the model of a criminal court, which punishes wrongdoers with a fine or even a professional sanction. There are several mixed systems which, depending on the case, order either a fine or compensation for the damage suffered. In general, the damage justifying the sentence must be financial, but some SAIs may also sanction moral prejudice or damage to image.

- Procedural rules also differ depending on whether the SAI is acting as a reparation judge, or as a repressive judge imposing penalties. In the latter case, the requirements of a “fair trial” are much more stringent.

- In “repressive” SAIs, the list of offences varies according to the law of each state. There are major differences between legislation. In Morocco, the Cour des Comptes can punish any infringement of a management rule. In Senegal, the law includes “squandering” among the punishable offences. In France, on the other hand, conviction requires proof that the offence is of a certain gravity and accompanied by significant financial damage, or that its author has obtained a personal interest from it.

- Furthermore, the list of those liable to prosecution varies from country to country. The main difference concerns political personnel, mainly members of the government (or even heads of state) who, in most countries, are not subject to the justiciability of the SAI, although there are some notable exceptions. Local elected representatives (mayors, for example) often benefit from a partially derogatory regime.

- Finally, the role of the public prosecutor, where one exists, varies considerably from one system to another. In general, it is responsible for taking public action, which does not mean that other authorities, whether administrative, political or judicial, cannot also refer cases to the SAI’s jurisdiction. In Italy, the role of the Public Prosecutor’s Office appears to be the most fully developed, since it is in charge not only of prosecution, but also of the investigation and examination of the case (for which it has a large number of specialized staff), and can order precautionary financial measures. The organization of the Public Prosecutor’s Office varies from one country to another, depending on national legislation: in general, there is a specific public prosecutor attached to a court of auditors; but in some countries (e.g. Spain), there is a national prosecution service (a single public prosecutor for all the country’s jurisdictions) with a department dedicated to jurisdictional SAI.

SAIs with a jurisdictional mandate are characterized by diversity of form and procedure, and by the singularity of the national laws that determine their powers and organization. But their common purpose remains the same: to guarantee citizens the effectiveness of the principle of accountability, by enabling the SAI to act not only as an auditor, but also as a judge.

The effective exercise, in accordance with professional standards, of a SAI’s jurisdictional powers improves the governance of states, strengthens citizens’ confidence in the management of public funds and, as a result, enhances the credibility and legitimacy of leaders.

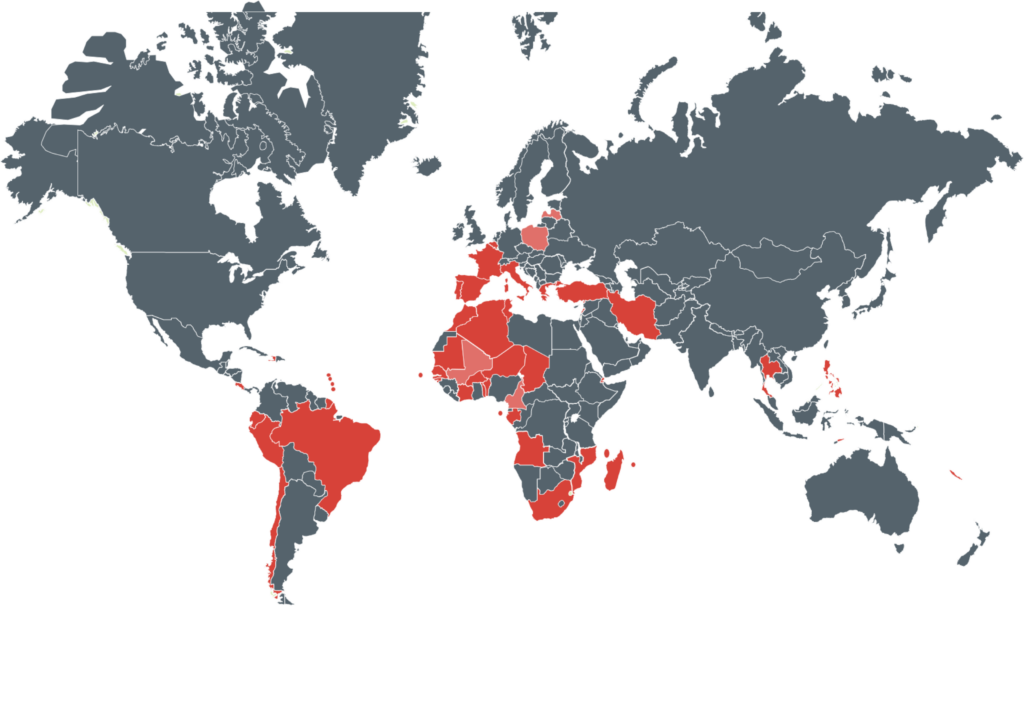

Map of countries that have SAIs with jurisdictional powers and membership in the Forum of Jurisdictional SAIs.

Legend:

Red: Members of the Forum of Jurisdictional SAIs

Light Red: Observers of the Forum of Jurisdictional SAIs

Source: Cour des Comptes