A New Handbook Highlights Ways External Audits Can Strengthen Budget Credibility

Recognizing the significance of budget credibility and the demand for further research and practical guidance on this critical topic, over the last two years Supreme Audit Institutions (SAIs) have collaborated with the Division for Public Institutions and Digital Government of the United Nations Department for Economic and Social Affairs (DPIDG/UNDESA) and the International Budget Partnership (IBP) to develop a handbook for auditors on how their work can contribute to improving budget credibility. The output of this far-reaching effort has been published recently in Strengthening Budget Credibility Through External Audits: A Handbook for Auditors.

Why the focus on budget credibility?

A country’s budget reflects its agreed priorities and commitments – and should be credible.

Revenue and spending plans presented in the national budget are expected to successfully deliver public services and advance sustainable development priorities. When the budget is implemented as approved by the legislature, the budget is considered “credible.” But, when the budget veers off course, trust in public institutions diminishes and the risk of corruption rises. In acknowledgment of the importance of credible budgets for effective, accountable, and transparent institutions, the global framework monitoring the Sustainable Development Goals (SDGs) has dedicated an indicator (#16.6.1) to measure it.

The urgency of strengthening budget credibility is further emphasized in a recent special report of the Secretary-General of the United Nations, “Progress towards the Sustainable Development Goals: Towards a Rescue Plan for People and Planet”, which points to:

- Multiple crises undermining budget credibility across all regions.

- Budget credibility (as measured via SDG16.6.1) deteriorating and reaching an average deviation of almost 10% for some regions in 2020- 2021.

Lack of credibility of the planning and budgeting system as a whole can compromise the delivery of critical services necessary for the attainment of the SDGs, and more broadly inhibit the transformation towards sustainable and resilient societies.

Supreme Audit Institutions are uniquely well-positioned to contribute to budget credibility

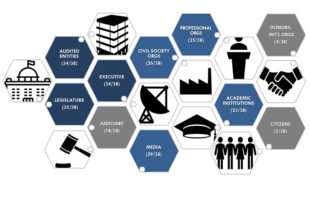

In their role auditing public funds and government policies, Supreme Audit Institutions (SAIs) can help identify deviations from the budget, examine why they are happening, and discern the impact on different groups or across policy areas. Independent, evidence-based, and publicly available audit reports can raise awareness of budget credibility and reveal how it relates to the performance of the country’s public financial management (PFM) system and ultimately the achievement of national goals and effective service delivery.

Audits help assess whether the country is meeting international commitments and budget standards. Checking and reporting on the legality and accuracy of public accounts, as well as the credibility of budgets, can be instrumental in governments delivering on their sustainable development promises.

Developing the handbook

When the idea for the handbook emerged in 2020, the literature on public finance management was very sparse on how auditors have contributed to understanding and assessing budget credibility. Thus, to kickstart this project, UNDESA and IBP released a report in 2021 to demonstrate how SAIs around the world had addressed budget credibility issues in their audits.

The handbook was developed in collaboration with SAI resource experts from Argentina, Brazil, Georgia, Indonesia, Morocco, the Philippines, Uganda, and Zambia. It has also benefited from the ongoing contributions and feedback from experts from SAI Jamaica, SAI South Africa, and the US GAO.

SAI experts worked together in workstreams, which focused on different methodological approaches to assess budget credibility including: (a) recurrent audits of the state budget execution, (b) audits of the performance of the entire public finance management system or its components, (c) audits of credibility risks across the budget cycle and in specific entities and programs, and (d) monitoring and follow-up to audit recommendations related to budget credibility.

The INTOSAI community has been engaged in the development of the handbook through several activities, including webinars, a survey conducted in early 2022, participation in technical meetings, a side event in the margins of the XXIV International Congress of Supreme Audit Institutions (INCOSAI), and presentations at meetings of relevant INTOSAI groups and regions such as the Working Group on Public Debt and OLACEFS’ Commission on SAI Performance Evaluation and Indicators (CEDEIR) to further discuss the contribution of SAIs to assessing and addressing budget credibility.

A critical milestone was the review meeting held in person in New York in June 2022. This provided an opportunity to share the draft chapters and get valuable feedback from experts and auditors on the drafts. The peer review process that followed was extensive and involved over 20 reviewers including experts from SAIs and other organizations.

Launched in July 2023, the handbook aims to share SAI audit practices relevant to assessing issues related to budget credibility and to support SAIs in improving their analyses of the credibility of government budgets. Specifically, the handbook (i) exposes SAIs to how their work can inform analyses of budget credibility; (ii) illustrates how audit work already conducted by SAIs provides insight on budget credibility; (iii) outlines and illustrates key steps that SAIs can contemplate when aiming to assess and address budget credibility; and (iv) shares existing SAI practices and experiences in this area.

The handbook promotes a systematic approach to assessing budget credibility through audits. Ultimately, in strengthening the role of SAIs in this area and advancing budget oversight and credibility within the INTOSAI community, this work strives to enhance budget credibility at the national level.

Contents

Following the Introduction, the handbook is organized into seven chapters:

Chapters 1 and 2 introduce the concept of budget credibility in the context of public financial management systems. These chapters identify several dimensions that can be considered in auditing credibility, and how SAIs may determine whether and how issues related to budget credibility could be audited and reflected in audit plans. These chapters present international standards and diagnostic tools that can be useful for auditors.

Chapter 3 focuses on how to identify and assess risks that relate to budget credibility at the whole-of-government level.

Chapter 4 presents examples of auditing the performance of the public financial management system or some of its processes and institutions. The chapter also presents tools other than audits that are used by SAIs to assess these aspects.

Chapter 5 provides guidance on auditing the execution of the state budget or the year-end accounts on a regular basis. These audits usually have a financial and compliance focus, but some SAIs have started to incorporate performance elements.

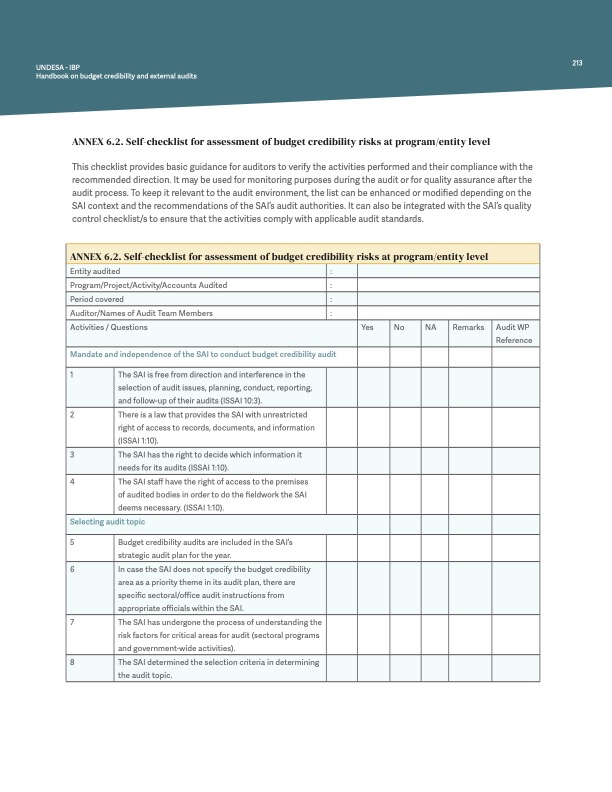

Chapter 6 examines budget credibility risks at the entity or program levels.

Chapter 7 focuses on audit reporting and the monitoring and following up to audit recommendations related to budget credibility.

For example, the handbook provides questions for SAIs considering prioritizing budget credibility (Box 2.4 in handbook)

Questions for SAIs to consider when deciding whether or how to prioritize budget credibility:

- Is the budget perceived as credible in the country?

- Is the PFM system performing according to international standards?

- What do aggregate indicators on the credibility of the budget indicate for the country (e.g., PEFA)?

- Has the government prioritized SDG 16.6.1 in its SDG implementation plans/national development plans?

- What might be the sources of budget deviations at the national level?

- Do government entities provide enough information on the rationale for budget deviations?

- Are budget deviations transparent?

- What are the impacts of budget deviations on the quality-of-service delivery?

- Are there indicators that budget deviations exist on the revenue/expenditure side and/or in spending composition?

- Are there indicators that budget deviations are relevant at entity or program levels?

Hands-on chapters

The handbook is practical in nature. Chapters focused on various methodologies to assess budget credibility include:

- A brief summary of the approach

- Relevant standards

- How-to practical steps and procedures

- Examples

- Tools and checklists

- Challenges and recommendations

Practical illustrations

All chapters include practical illustrations from different regions. Selected examples include:

- Analysis of systemic causes of unreliable revenue and expenditure forecasts (Uganda)

- Budget credibility and performance indicators and information (New Zealand, Rep. of Korea)

- Use of the Public Expenditure and Financial Accountability (PEFA) framework to assess budget credibility (Peru)

- Audits of the performance of specific public financial management (PFM) processes, using Risk-Impact-Auditability-Significance (RIAS) method and big data analytics (Indonesia)

- Examples of positive impacts of SAIs auditing the performance of the PFM system (Latvia, Ireland, Egypt)

- Combining financial, compliance and performance audit to assess the year-end accounts (Brazil)

- Audit questions to assess budget credibility risks at program level (Philippines)

- Communication strategy and leveraging information and communications technology (ICT) for monitoring recommendations (Georgia, Indonesia, USA)

- SAI-civil society collaboration improved budget credibility and health sector outcomes (Argentina)

Numerous tables and annexes provide useful tools such as checklists, sample audit questions, and audit planning matrixes, among other resources.

The handbook is a living document that will benefit from inputs from different stakeholders and from the practical experience of auditors using the handbook in their audit work going forward.

Moreover, it provides a shared understanding of budget credibility for SAIs and other stakeholders, such as budget officers. The existence of common methods, shared premises and the same language is critical to strengthening collaboration between SAIs and other actors, and to creating institutional spaces where joint efforts can help strengthen budget oversight and accountability.

Going forward

The launching of the handbook culminates a joint effort but also marks the beginning of new activities to enhance budget credibility and the contribution of SAIs and auditors. There are various opportunities to put the handbook in practice going forward.

- Piloting the handbook: engage with the INTOSAI community and other stakeholders and collaborate with SAIs to integrate credibility into audit planning and to conduct audits on budget credibility, using different approaches.

- Promoting peer learning: develop training contents and products, and support knowledge-sharing and mutual support and collaboration among SAIs and with other stakeholders on budget credibility audits.

Authors:

- Claire Schouten (IBP)

- Cora Lea A. Dela Cruz, Josephine B. Manalo, and Paul Jonel Pollicar (Commission on Audit of the Philippines)

- Cynthia Grace Matimba, Ngawa Mphande, and William Chibesa (National Audit Office of Zambia)

- Neemias Albert de Souza and Roberto Santos Victer (Federal Court of Accounts of Brazil)

- Maximiliano Castillo Carrillo and Anibal Kohlhuber (Office of the Auditor General of the Nation of Argentina)

- Martin Bamulumbye and Peter Oyo Mugenyi (Office of the Auditor General of Uganda)

- Mouhcine Hanoun and Abedaali Ouissole (Court of Accounts of the Kingdom of Morocco)

- Tsotne Karkashadze and Lasha Kelikhashvili (State Audit Office of Georgia)

- Winarno, Thopan Aji Pratama, Ramadhan Nugraha Putra, and Anisa (Audit Board of The Republic of Indonesia)