The Importance of Follow-Up Audits: Insights from the Auditor General of Thailand

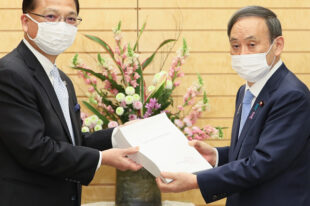

Author: Monthien Charoenpol, Auditor General, State Audit Office of the Kingdom of Thailand

As the Auditor General of Thailand, I have observed firsthand the key role that follow-up audits play in ensuring the integrity and effectiveness of government financial management. The State Audit Office of the Kingdom of Thailand (SAO) is committed to rigorous follow-up procedures that uphold our mandate under the Organic Act on State Audit B.E. 2561 (2018).

In Thailand, the primary responsibility of the Auditor General includes scrutinizing the expenditure of public funds, assessing financial operations, and verifying compliance with relevant laws, regulations, Cabinet resolutions, and governmental standards. This extends to revenue collection, asset management, and the safeguarding of state resources.

When our audits uncover violations or deviations from fiscal discipline—whether due to non-compliance with financial regulations, negligence, or intentional misconduct—we are compelled to act. Under the Thai State Audit Act, we notify the audited entity to rectify the issue, which may involve disciplinary action or restitution to the state within a specified timeframe.

The follow-up process is critical. If the head of an audited entity fails to comply without justifiable reasons, the SAO will enforce administrative penalties as outlined in our Act. These penalties include reprimands, public disclosure of the misconduct, and administrative fines not exceeding twelve months’ salary of the individual at fault. Additionally, we may recommend disciplinary action or seek restitution from officials who violate financial regulations.

One key aspect of our follow-up process is ensuring that any administrative penalties imposed can be appealed to the Supreme Administrative Court within ninety days. The court’s deliberations must consider the policies and standards of state auditing.

This robust follow-up mechanism underscores our commitment to transparency and accountability. It serves as a deterrent against fiscal mismanagement and reinforces the principles of prudent financial administration.

The SAO’s diligent follow-up procedures have proven effective in enhancing compliance and ensuring that public resources are used efficiently and for their intended purposes. Our approach not only addresses immediate issues but also fosters a culture of continuous improvement within audited entities.

As we move forward, the SAO remains dedicated to sharing our best practices with the global audit community. We believe that through collaboration and the exchange of knowledge, we can collectively enhance the efficacy of public sector auditing worldwide.

In conclusion, the follow-up process is not merely an administrative requirement but a cornerstone of effective governance. It ensures that our audits lead to tangible improvements and uphold the public trust in governmental financial management.

Monthien Charoenpol

Auditor General

State Audit Office of the Kingdom of Thailand