The Australian National Audit Office Develops Methodology for Auditing Ethics

The importance of ethics in government programs has been highlighted in multiple Australian National Audit Office (ANAO) audits, particularly those examining procurement and grants administration. The lack of adequate documentation and records to support the rationale for decisions made and actions undertaken by audited entities is a consistent theme.

In his mid-term report, Auditor-General Grant Hehir identified the ANAO’s consideration of ethics as an area for improvement, and pointed to the need to develop a framework and methodology for assessing the ethical use of public resources, in addition to looking at technical compliance with rules and policy frameworks.

A Framework for Auditing Ethics

The ANAO consulted with the Australian Public Service Commission and the Department of Finance to develop a framework for auditing ethics based on existing Australian Government Sector ethical requirements.

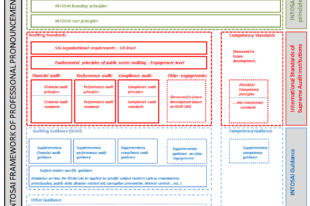

The ANAO defines the Australian Government Sector ethical framework as:

- The legal framework applicable to the entity being audited. The legal framework applying to all Australian Public Service (APS) agencies comprises the finance law and the law governing the operation of the APS including the APS Values and Code of Conduct.

- Activity-specific frameworks (that is, key public sector resource management frameworks for specific Australian Government activities such as the Commonwealth Grants Rules and Guidelines and the Commonwealth Procurement Rules).

- Government Policy Orders, which are orders made by the finance minister under finance law that specify a policy of the Australian Government that is to apply to the entity being audited.

- Entity-specific frameworks, which may include, for example, the entity’s policies, guidelines and procedures.

The selection of the appropriate elements of the ethical framework to apply to an audit will depend on the type of entity being audited, the type of audit and any circumstances unique to the activity being audited.

The Australian Parliament has established requirements in the Public Governance, Performance and Accountability Act 2013 (PGPA Act) including to require the Commonwealth and Commonwealth entities to use and manage public resources properly (section 5). The accountable authority for an entity responsible for relevant money has a duty under section 15 of the PGPA Act to promote the proper use of the money for which the accountable authority is responsible. ‘Proper’, when used in relation to the use or management of public resources, means efficient, effective, economical and ethical (section 8). The ANAO assesses all aspects of the proper use of resources, with effectiveness being the most common of these objectives examined.

The Department of Finance PGPA Glossary defines ethical as:

- the extent to which the proposed use of public resources is consistent with the core beliefs and values of society. Where a person behaves in an ethical manner it could be expected that a person in a similar situation would undertake a similar course of action. For the approval of proposed commitments of relevant money, an ethical use of resources involves managing conflicts of interests, and approving the commitment based on the facts without being influenced by personal bias. Ethical considerations must be balanced with whether the use will also be efficient, effective and economical.

The Australian Parliament has also established, through the Public Service Act 1999 (PS Act), the APS Values set out in section 10. Subsection 10(2) states that: ‘The APS demonstrates leadership, is trustworthy, and acts with integrity, in all that it does’. The APS Commissioner has made directions under the PS Act including in subsection 16(f) requiring accountability of APS members by ‘being able to demonstrate clearly that resources have been used efficiently, effectively, economically and ethically’. A mandatory code of conduct is set out in section 13 of the PS Act for APS employees.

In conducting performance audits of entities, the ANAO obtains evidence to inform an assessment of whether the audited entity executes its activities in accordance with the requirement to promote proper use of public money. Findings may be made as to whether the use or management of public money was efficient, effective, economical and ethical. In forming an overall conclusion in a performance audit, the ANAO may also form a view on whether the entity’s activities have been executed in accordance with both compliance with the Rules framework and the intent of that framework, including the requirements of the PS Act for the APS (the entity) to act with integrity in all that it does.

Where ANAO findings or a conclusion are made as to whether the use or management of public resources by the entity has been ethical, it is a matter for an accountable authority to assess whether the audit findings in the particular case reflect the broader posture of the entity or relate to individual APS staff conduct.

PGPA Act requirements, including ethical requirements, directly inform key public sector resource management frameworks for specific Australian Government activities addressed through performance audits. These frameworks contain ethical requirements specific to the activity they regulate. Examples of such frameworks include the Commonwealth Procurement Rules and the Commonwealth Grants Rules and Guidelines. Commonwealth entities may also be subject to one or more Government Policy Orders, which are orders made by the finance minister under the finance law that specify a policy of the Australian Government that is to apply to the entity being audited. Finally, the ANAO may also audit against the audited entity’s specific frameworks, such as policies, guidelines and procedures that establish ethical requirements.

A Methodology for Auditing Against the Framework

While methodologies for internal audits of ethics and entity culture are well documented, both within and outside of Australia, such methodologies for independent audits of ethics in public sector entities are not readily available. The ANAO consulted with the Institute of Internal Auditors Australia to help inform the development of practical guidance on auditing against the Australian Government Sector Ethical Framework.

There are three scenarios included in the methodology under which ANAO performance audits may include consideration of ethics: effectiveness audits of ethical frameworks; audits with specific ethical criteria; and audits which include consideration of ethics in findings.

The objective of an effectiveness audit of ethical frameworks is to examine the effectiveness of the establishment or implementation of the Australian Government Sector ethical framework by the audited entity or entities. This type of audit incorporates aspects of audits of effectiveness of governance frameworks, compliance with ethical frameworks and organisation culture.

Audits with specific ethical criteria have a narrower focus and consider specific matters such as compliance with ethical requirements as one of the criteria in a performance audit, which is also considering effectiveness, efficiency or economy. For example, in an audit considering effectiveness of a procurement, the ethics of decision-making in the conduct of public administration, the provision and consideration of advice, and evidence and management of conflicts of interest and probity may also be considered. This type of audit would conclude on whether the procurement was ethical, as well as effective and economical.

In audits which include consideration of ethics in findings, there are no specific criteria regarding ethics, but during the course of the audit as findings relating to effectiveness, efficiency or economy are made, there is consideration of whether those findings also indicate unethical conduct.

The methodology also provides a framework for applying the ethics methodology to any performance or financial audit throughout the typical phases of an audit i.e. assessing and responding to the risk of ethical matters on the audit, assessing if findings are of an ethical nature, assessing the materiality of ethical findings, the impact of ethical findings on the overall audit strategy and risk assessment, reporting ethical findings, and the impact of ethical findings on the audit conclusion.

Following further consultation, both broadly within the ANAO, and externally with those previously consulted as well as the Office of the Auditor-General New Zealand, the ANAO’s framework and methodology for assessing the ethical use of public resources were finalised in November 2022.

Recent Audits with Ethical Considerations

As the ethics methodology was being developed, the ANAO continued to assess all aspects of the proper use of resources. In some audits where instances of non-compliance with key ethical behaviour requirements were identified, the ANAO included an appendix to the audit report summarising these key requirements and the findings raised. The first example of such an audit is Digital Transformation Agency’s Procurement of ICT-Related Services, including Appendix 3 Ethical behaviour requirements. In this audit, the ANAO concluded that for the procurements examined, the entity did not conduct the procurements effectively and its approach fell short of ethical requirements. Findings included conflicts of interest not being identified and managed by officials involved in procurement, the entity not dealing with potential suppliers equitably, and a senior entity official accepting a gift from a supplier.

More recently, the audit of the Department of Health and Aged Care’s administration of the Community Health and Hospitals Program was found to be ineffective and fell short of ethical requirements. In this audit, the ANAO found several instances of non-compliance with the requirement in the Commonwealth Grants Rules and Guidelines to ensure that decisions relating to grant opportunities are impartial, appropriately documented and reported, publicly defensible, and lawful.

The Future of Auditing Ethics

With the methodology finalised, the ANAO is signalling its intent to start applying greater scrutiny to the public sector for the ethics of their decisions. It has been noted in the ANAO’s Corporate Plan 2022-23 and Annual Audit Work Program 2022-23. Implementation of ethical frameworks in APS Agencies is listed as a potential audit topic in 2022-23. The Auditor-General and staff of the ANAO have also presented at several external forums, including the Audit Committee Chairs Forum in December 2022. At this forum, the Auditor-General presented insights on integrity and ethics, and the ANAO also facilitated a panel discussion and Q&A titled ‘Spotting ethical red flags in procurement’. At the International Meeting of Performance Audit Critical Thinkers (IMPACT) in April 2023, the ANAO moderated a panel discussion on ‘ethical and integrity challenges in Government’. The panellists were John Ryan, Controller and Auditor-General, Office of the Auditor-General, New Zealand/Secretary General of PASAI; Dr Gordon de Brouwer PSM, Secretary for Public Sector Reform, Australia; and Daniele T Bird, Partner, EY Australia.

An ethics panel discussion involving several senior ANAO staff featured in LearnFest – the ANAO’s annual whole-of-office festival of capability, continuous learning, community and culture – held in November 2022. Training on the methodology has been provided to all ANAO auditors in the first half of 2023.It is hoped that greater scrutiny in the area of ethics will help ensure that the public sector is looking beyond technical compliance and operating in line with the intent of established rules and frameworks, alongside community expectations of integrity. A culture of integrity in an organisation flows from the standards set by its leaders.