SAI Latvia and the Practice of Recovery of Losses

The State Audit Office of the Republic of Latvia (SAI Latvia) is an independent and collegial supreme audit institution (SAI) with its mandate specified in the Constitution of the Republic of Latvia.

Specifically, SAI Latvia has the mandate to notify public entities of the findings on public finance management which pertain to them, and to notify law enforcement authorities of violations of legal provisions detected during an audit. However, SAI Latvia does not have the right to make decisions on punishing officials who commit unlawful actions.

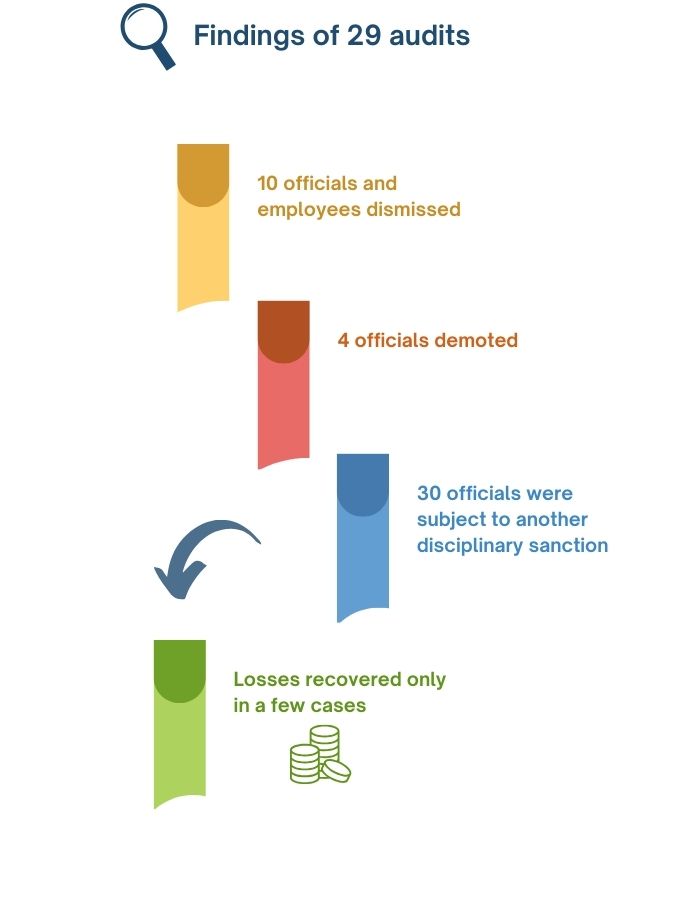

Based on findings of a study carried out by SAI Latvia on 29 of its audits performed from 2006 – 2014, it was determined that there was a fair number of cases on recovery of losses during the period studied.

Upon reflection on the role of the SAI, a proposal was drafted to amend the Law on SAI Latvia and provide SAI Latvia with a new function: to initiate the process and to take decision regarding the recovery of losses.

SAI Latvia does not fall into the category of SAIs with jurisdictional powers (see, e.g. ISSAI 4000 – Compliance Audit Standard, paras. 153-157). SAI Latvia recovers losses in accordance with the subsidiarity principle and gets involved if the audited entity itself does not take action. It should be specified that SAI Latvia auditors are not required to evaluate whether there is sufficient and appropriate evidence that the public official can be held personally liable for acts of non-compliance as mentioned in paragraph 153 of ISSAI 4000.

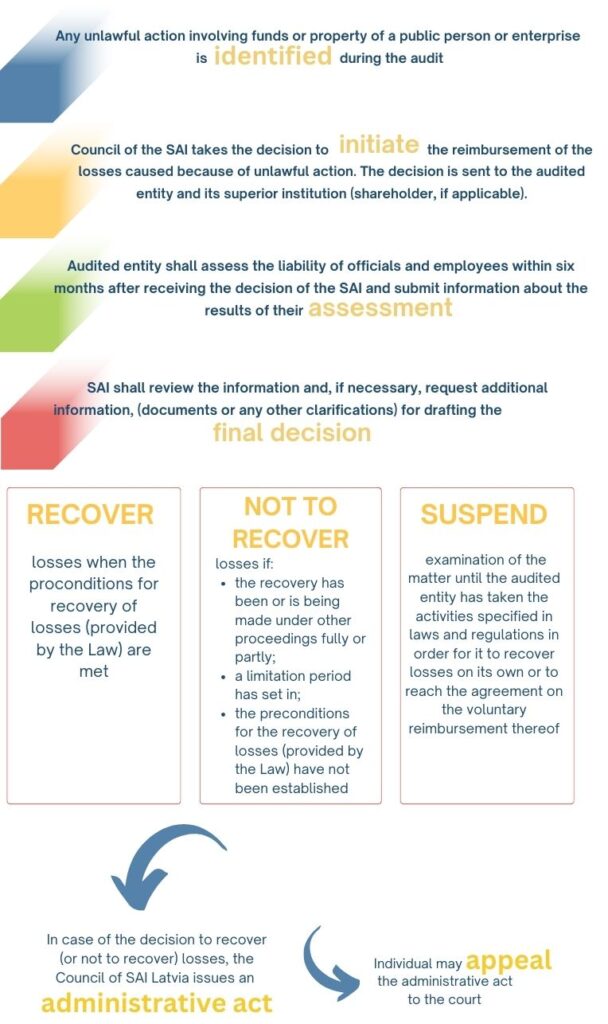

The new regulation was adopted and applied to audits commenced after 31 July 2019 and, inter alia, provides as follows:

- Losses shall be recovered within four years from the committed violation.

- The termination of service of the employee shall not be grounds for not recovering the losses.

- Losses shall be reimbursed if they have been caused due to gross negligence or malicious intent.

- The decision on the recovery of losses may be appealed in accordance with the Administrative Procedure Law.

- Execution of the decision on the recovery of losses shall be ensured by the bailiff.

The introduction of this new function is intended to achieve certain goals – 1) prevention of non-compliance and unlawful acts which cause losses and 2) actual recovery of losses caused to public funds (resources), and not only in minor cases.

It is important to promote responsibility and awareness that any action with the financial resources and property of a public person (which includes both public entities and officials) shall conform to the objectives and procedures provided for in laws and regulations.

SAI Latvia strives to prevent cases of unlawful action, as well as to spread awareness that any unlawful action in the public sector is not tolerated.

During the almost five years that have passed since the introduction of this new function, the regulation has been applied in 23 cases for losses totalling more than 273 615 euros.

(Actual application started in 2021 after the first audit reports were adopted since the entry into force of the new regulation.)

Although SAI Latvia has applied its new function and recovered significant losses, it still faces some challenges with the new initiative, such as:

- Improving the process of recovery of losses to increase its effectiveness and to use as few resources as possible. This requires constant assessment of the level of severity attained in light of the financial impact and the importance of the case. E.g., a case where the amount of losses in question is small may seem prima facie insignificant, but may turn out to be of landmark nature for development of SAI case-law.

- Establishing and proving guilt, such as gross negligence or malicious intent. Personal liability may be a necessary precondition for the recovery of losses.

- The audit results and the audit report may not provide sufficient factual and legal basis for the recovery of losses. Close cooperation between auditors and legal support staff is necessary before the audit is completed.

From the application of SAI Latvia’s new function, some examples of violations resulting in losses identified are:

- Violation in paying remuneration to officials, including supplements, bonuses, extra payments in greater amount as allowed by law.

- Violation of prohibition provided by law to purchase a property or a service for an increased price.

- Rent discounts are granted to individuals in cases where it is not permitted by law.

- Remuneration paid to employees for compliance with an agreement regarding the restriction of the occupational activities of the employee (restriction on competition) after termination of the employment relationship for the time when employees were reemployed in the same workplace.

- Contracts with officials for the performance of tasks already falling within their duties as representatives of the institutions concerned, thus exceeding the maximum permitted amount of allowances for additional work which would be payable in the specific case.

Currently SAI Latvia is reviewing the data on the implementation of this function and, along with the consideration of faced challenges and benefits to society – intends to analyse the effectiveness of implementation. This pertains not only to specific savings gained but also to less tangible benefits. The impact of the successful use of this instrument by SAI Latvia in increasing the awareness and focus of government officials on the financial implications of their actions is one soft benefit which SAI Latvia will explore.

Authors:

State Audit Office of the Republic of Latvia

Gustavs Gailis, Acting Head of Legal Division

Silvija Nora Kalnins, Head of Strategy and International Relations Division

Elita Nīmande, Acting Deputy Head of Legal Division

Agnese Rupenheite, Head of International Relations and Project Development