Jurisdictional Control of the Court of Auditors in Madagascar: Challenges and Prospects

Author: Jean de Dieu Rakotondramihamina, President of the Cour des Comptes of Madagascar

The French Cour des Comptes, created in 1807 under Napoleon, is one of France’s oldest institutions. It acquired its authority through jurisdictional control of public accountants’ accounts, its primary mission. This type of control was subsequently adopted by other French-speaking, Portuguese-speaking and Spanish-speaking countries. In Madagascar, the Cour des Comptes is facing challenges with a complex issue linked to jurisdictional control. This article aims to elicit questions and reactions to this situation, in order to highlight the importance of the challenge of jurisdictional control of the Malagasy Cour des Comptes, while shedding light on its raison d’être, in promoting the sound management of public funds.

Madagascar’s Cour des Comptes faces systemic and procedural challenges

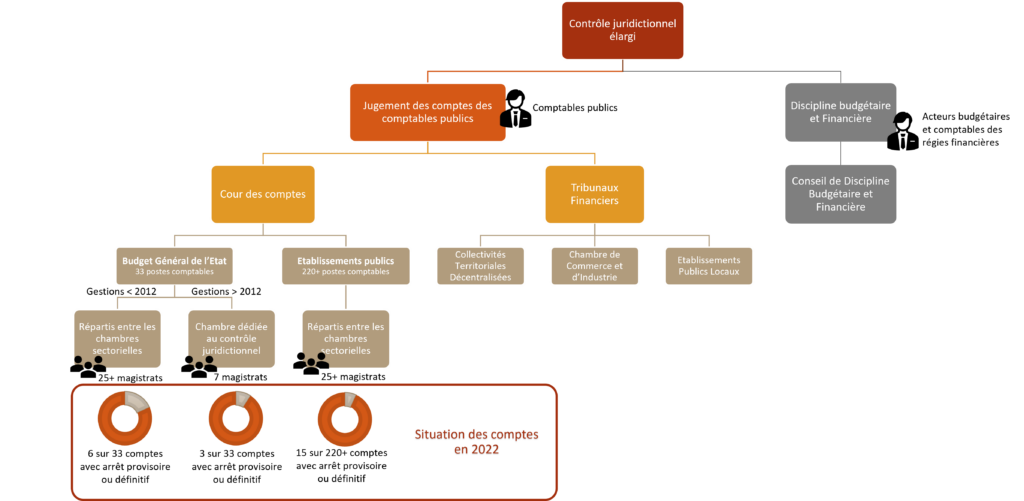

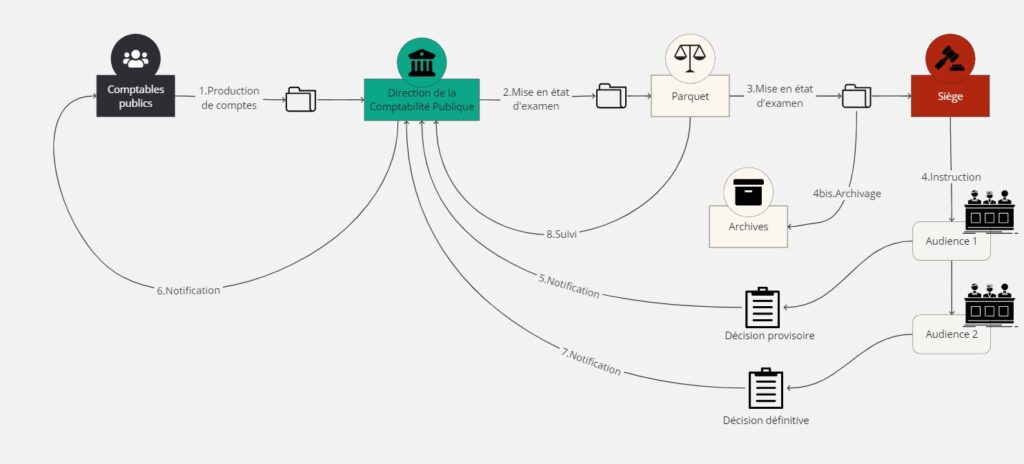

By way of introduction, it is essential to understand the organizational configuration and inherent responsibilities of the Cour des Comptes (or Court of Audit) of Madagascar in terms of jurisdictional control. The scope of the audit area is illustrated in Figure 1, providing an initial overview of the associated workload. Figure 2 illustrates the main stages in the implementation of jurisdictional control in Madagascar, as it stands today.

Budgetary and financial discipline (DBF): an emerging mission to balance control

Currently, two systems coexist in the world: the first entrusts the Budgetary and Financial Discipline (DBF) to a separate, independent structure, as is the case in Madagascar (see Figure 1), while the second, more widespread, integrates discipline into the Cour des Comptes itself. The duality of the first system is criticized for its complexity, resource inefficiency and ineffectiveness. This is also confirmed in Madagascar, where the Budgetary and Financial Disciplinary Council (or Conseil de Discipline Budgétaire et Financière in French, referred to as the CDBF), as a separate body, is accused of complicating procedures, with a restricted referral and administrative decisions subject to appeal to the Council of State. The non-integration of the DBF in Madagascar thus seems to hamper the credibility and governance of the SAI, with adverse consequences for the regularity and management of public expenditure.

The international trend is towards a single structure, where the DBF is integrated into the Cour des Comptes. It then acts as a chamber within the Court of Auditors, ensuring control of compliance and financial morality. The Association of Supreme Audit Institutions sharing the use of the French language (AISCCUF) recognizes the importance of the DBF in strengthening the credibility of SAIs and improving public governance by promoting a culture of regularity and good management.

A heavy burden on the Cour des Comptes’ human and material resources

The INTOSAI Development Initiative’s (IDI) analysis of the legal framework of Madagascar’s SAI in 2021 highlighted the Court’s limitations in its human and financial resources. With current resources, it would take several years devoted exclusively to jurisdictional control to clear the accounts, despite its original and priority nature. However, non-jurisdictional control and audit work has proven to have a greater impact on the credibility and visibility of the institution, as well as on the individual development of magistrates. Focusing exclusively on jurisdictional control could jeopardize staff motivation and the visibility of the SAI.

As far as archives are concerned, the backlog of judgments is leading to a massive accumulation of bundles at the Court of Audit. Pending accounts, some of which are more than 20 years old, have led to a volume of archives in 2023 greater than that of the national archives of Madagascar, for a smaller storage space, with an annual increase of around 10% in the absence of prescription and elimination. This overcrowding is detrimental to the quality of archive conservation and management (see Figure 3), especially as the Court, with its limited resources, cannot afford to acquire more space to properly accommodate the new accounts each year.

Failure to respect the reasonable time limit due to the legal framework for judicial review

The statute of limitations, usually enshrined in the French Civil Code, is designed to protect individuals. However, within the legal framework of the judgment of accounts in Madagascar, which fall within the public financial domain, prescription is non-existent. This creates legal uncertainty for accountants, and undermines the quality of auditing. Public accountants must render accounts annually, but the SAI has accumulated a liability: delays in judging accounts penalize public accountants, depriving them of certain legitimate rights such as the recovery of deposits or the payment of retirement indemnities on leaving office. In response to a question about what accountants expect from the Cour des comptes, one Treasurer General said: “That the Court should grant the accountant an ex officio discharge when the accounts submitted to the judge have been out of date for five years”, which is perfectly legitimate. However, a revision of the text on the Cour des Comptes is unavoidable, as current legislation makes no provision for the statute of limitations, whereas this has become a principle in other SAIs such as Morocco and France.

The double decision rule, a source of procedural complexity

The double decision rule applied in Madagascar’s financial jurisdiction poses additional challenges (see Figure 2). Although this rule is designed to respect the rights of defense of those subject to trial, it means that the Cour des Comptes issues a provisional ruling requiring public accountants to respond within two months, before making a final decision. This leads to unjustified delays and may encourage reprehensible behavior. The two-month deadline is considered excessive, and notifications must go through the Direction de la Comptabilité Publique (Public Accounting Department), which can cause delays. By comparison, some SAIs have abandoned this rule.

What’s more, in some cases, such as that of the Agent Comptable Central des Postes Diplomatiques et Consulaires (Central Accounting Officer for Diplomatic and Consular Posts), secondary accountants report to a centralizing accountant, who submits a single management account to the Cour des Comptes. This accountant can be held responsible for irregularities committed by secondary accountants. In addition to making the procedure more cumbersome, this is contrary to the principle of “no one can count for anyone else”, according to which each public manager is responsible for his or her own actions, and responsibility cannot be transferred to others.

Risk of ineffectiveness of the Cour des Comptes’ sanctions through the Minister’s “remise gracieuse”

The effectiveness of the Cour des Comptes’ sanctions may be compromised by the “remise gracieuse“, or grace period, granted by the Minister of Finance and Budget. Although this remission may serve to adjust equity, its disadvantages are considerable. Despite its legal basis, the remise gracieuse can lead to abuse, limiting the effective power of the audit judge and weakening the accountability of accountants. This practice leads to a confusion of powers, allowing the minister to apply sanctions in a discretionary manner. This can lead to discriminatory treatment, contrary to financial justice. Moreover, the remise gracieuse violates the principle of “res judicata” and “parallelism of form”, calling into question the Court’s decisions by an administrative authority not competent in matters of financial justice.

Prospect: The need to adapt the Court’s controls

Experimenting with clearance methods

To reduce the backlog of audited accounts, the Cour des Comptes of Madagascar has considered a number of auditing techniques used by similar SAIs.

Amnesty

Madagascar has on several occasions resorted to amnesties to clear outstanding management accounts(1), not only the accounts of the general State budget, but also those of decentralized bodies such as local authorities and public establishments. This fast-track approach, similar to criminal amnesty, wipes out irregularities without legal proceedings. However, this simplicity has major drawbacks: by discharging errant accountants without investigation or prosecution, amnesty can promote a culture of impunity. Accountants unaware of their actions could repeat amnestied errors in future management. Amnesties also overlook the errors and anomalies of past management, neglecting the need to correct faulty practices.

Although these laws have made it possible to clear outstanding accounts, some, such as the 2001 law, have been repealed due to contradictions.

Lean control

The “light audit” is a simplified audit procedure. This approach offers two options: a verification limited to general documents to establish the lines of accounts, favoring rapidity but also risking impunity; and a verification of general documents with certain supporting documents, enabling faster clearance while ensuring the regularity of management, although not exhaustive. The SAIs of Senegal and Burkina Faso have adopted this approach to clear overdue accounts.

In Madagascar, for accounts prior to 2012, a very light audit is applied, fixing the account lines without checking the supporting documents, due to the complexity linked to the age of the management. However, for management accounts between 2012 and 2017, a different approach is adopted, involving the verification of certain supporting documents to detect irregularities, in addition to the determination of account lines. Significant irregularities were discovered, requiring a more in-depth approach.

A change of strategy

More recently, faced with the pressing challenges of delays in judgments, the Malagasy Cour des Comptes has reassessed its priorities, to put the emphasis in its annual work plan on fulfilling its primary mission: jurisdictional control. While in the past, investigating magistrates were often called upon to carry out non-jurisdictional work, they are now called upon to devote part of their resources to judging accounts, in order to avoid further backlogs.

The need to extend jurisdiction to budgetary players

As part of its 2020-2025 strategic plan, the Court is consulting various stakeholders, including public authorities, on the integration of the CDBF, to extend jurisdictional control to the budgetary and accounting actors of the financial authorities. A merger-absorption could improve the effectiveness and efficiency of control, by avoiding overlapping controls and limiting competition between bodies. The Malagasy CDBF is criticized for its administrative nature, its attachment to the Prime Minister’s Office, and the exclusion of ministers from its scope. Integrating it with the Cour des Comptes would result in integrated, cost-effective and efficient control, and guarantee fair accountability for all players involved in public spending.

Furthermore, judicial control is considered to be at the heart of the Court’s missions. An expanded jurisdictional control could become an effective trigger for the Court’s other missions, such as compliance audit, performance audit, financial audit, certification of accounts, and evaluation of public policies. The Court suggests that the effectiveness of judicial control should feed into these missions, emphasizing the interconnection between them.

Gradual acquisition of criminal jurisdiction by the Cour des Comptes, and long-term reform.

In the long term, reforms will be needed in the Malagasy judicial system, in particular to enable the Cour des Comptes to gradually acquire criminal jurisdiction. Indeed, the multiplication of special courts complicates the system, risking conflicts of jurisdiction. The creation of the Anti-Corruption Center (PAC) has met with challenges, notably the reluctance of certain magistrates and questions about its effectiveness in purifying deviant behavior. The personal ethics of magistrates should be the crucial element in their intrinsic motivation. However, extrinsic motivation, such as higher salaries, is not necessarily effective in driving ethical behavior.

Different options can be considered for involving financial magistrates in the handling of budgetary and financial cases with criminal connotations, each with their advantages and disadvantages. For example, a two-stage transition could be envisaged: the first involves collaboration between the Cour des Comptes and the criminal courts, with financial magistrates intervening on an ad hoc basis, either at prosecution or investigation level, during a period of experimentation followed by evaluation. The second stage would involve a complete transfer of the entire jurisdiction to the Cour des Comptes, necessitating an internal reorganization of the Court and the specialization of preliminary investigations.