The Digital Revolution: Threat or Opportunity for the Audit Profession

by Ellen van Schoten, Secretary-General of the Netherlands Court of Audit

The audit profession in the Netherlands has been involved in a series of major incidents in recent years. The good news is that the Dutch audit profession has adopted a raft of measures since we wrote to Parliament in 2014, highlighting the main concerns from a public-sector viewpoint. The question is whether we are fighting the final battle in the war to restore public trust or just the next in a long series of battles. Does the audit profession have a future in a world of big data, block chains and robotics? Will the public sector remain an attractive market for the Big Four? And, last but not least, how will these developments affect us as Supreme Audit Institutions (SAIs)?

Since 2014, Dutch audit firms and the Dutch Institute of Chartered Accountants have acted in response to major incidents involving poor quality of work and inappropriate behavior in the audit profession. This is a matter of serious concern, as the quality of the audits performed by private audit firms working for the public sector should be beyond reproach. The latter is a precondition for public confidence that governments exercise due care in spending taxpayers’ money. The Dutch Institute of Chartered Accountants responded promptly to mounting public pressure to improve the quality of audits and came up with 53 proposals for improvement.

What do the Proposals Involve?

Among the key elements are a system of quality-based remuneration and a claw-back scheme for audit partners, a better leverage model and a promotion policy which takes proven professional qualities as its starting point. Over and above these voluntary initiatives, the government is also planning to take statutory measures to improve the quality of audits. One of these is the institution of a mandatory internal supervisory body, along the lines of a supervisory board in the two-tier continental corporate governance system. The thinking is that independent, internal supervision should force audit firms to adopt a long-term policy aimed at integrity, independence, professional skills and effectively changing the corporate culture. Another new statutory requirement will be for members of executive and supervisory boards at audit firms to pass a fit-and-proper test. Audit firms must be run by people who have the right knowledge, professional qualities and competencies.

Reclassifying semi-public institutions

The Dutch Minister of Finance also announced in 2015 that housing corporations, energy network operators, big pension funds and major scientific policy institutions would henceforth be classified as Public-Interest Entities (PIEs). This means that the auditors auditing their financial statements will be subject to stricter requirements. While classifying an organization as a PIE can undoubtedly help to improve quality awareness, it could raise audit costs. Rates in the public sector are already under pressure, and the question is whether the big audit firms will continue to regard the public sector as an attractive market.

Two problems not addressed

Two vital issues are not addressed by the 53 proposals for improvement. The first is knowledge of the public sector. The public sector is a huge domain, ranging from education to care and central government. Each individual element of this domain comes with its own laws, rules and financial regulations, as well as its own stakeholders. Given the expectation gaps between what stakeholders want or believe to be the purpose of an audit and what auditors actually provide by way of assurance, auditors must be aware of the specific needs of different stakeholders. This aspect does not play a prominent role in the training of Dutch auditors, which means that newly qualified accountants have to acquire this knowledge in practice.

Then there is the challenge of digitization. How will the digital revolution affect the audit profession: is it a threat or an opportunity? Will it help the profession to regain public trust? While computerization has historically been confined to routine tasks involving explicit, rule-based activities, algorithms for big data are now rapidly entering domains reliant upon pattern recognition and could readily substitute for labor in a wide range of non-routine cognitive tasks. This is likely to change the nature of work across industries and occupations. Does the audit profession, including both private and government auditors, have a future?

Big Data: Transforming Audits

The accepted wisdom is that big data will have a massive impact in terms of enhancing productivity, profits and risk management. One area with significant potential is the transformation of audits. Transformed audits will probably expand beyond sample-based testing to include an analysis of entire populations of audit-relevant data, using intelligent analytics to deliver a higher quality of audit evidence and more relevant insights. How will this affect the business model of the big audit firms?

From Open Data to Citizens’ Audits?

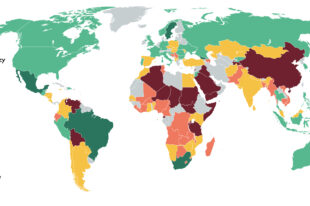

What if big data is also open data? The open data movement came into its own when President Obama issued his first policy paper in January 2009, prompting the US government to open up thousands of datasets to public scrutiny. Other countries followed suit, opening up data to their citizens. Further progress has been made since then, though it has been slower than expected. In March of this year, the Netherlands Court of Audit concluded that, “Although the availability of open data has doubled in the past year, the increase has been due chiefly to the inclusion of data from Statistics Netherlands. Apart from this, few datasets have been opened up, even though many more could be. The Dutch government is missing opportunities.”1

Nonetheless, open data has enormous potential, for example, in tracking and analyzing government spending. Citizens could, in the future, track government spending to specific postcodes, and, hence, start communicating with governments and influence government spending.

So, could they end up actually auditing government spending? If so, how will this affect us as auditors and SAIs?

The honest answer is that we do not know yet. But there could be a time when our mandate as a SAI is not as extensive as it once was, simply because most data are open and accessible to all interested citizens who can act as armchair auditors using new technology. In this world of massive, unstructured and open data, what will be our role as SAIs and what will be the purpose of an audit opinion? How will this affect public trust?

Block Chains: The Road to Truth and Fairness?

Finally, let’s look at block chains. A block chain is essentially a record of digital events—one shared by different parties. It can be updated only with the agreement of the majority of the participants in the system. Once a block of data has been recorded in a block chain ledger, it is extremely difficult to change or remove. A block chain is a way of stating the truth and fairness of a transaction. That, in a nutshell, is what auditors do in expressing an opinion on the truth and fairness of financial statements. The intriguing question is: will block chains displace auditors? And SAIs? Or, are they simply an opportunity to involve the public in government spending? Only time will tell.

Conclusion

Let’s take a look at the situation in the Netherlands. The good news is that steps have been taken to restore public trust in the audit profession. Unfortunately, the measures taken do not take into account the huge impact of digitization. The real question government and private auditors need to ask themselves is: how can we add value in tomorrow’s world?

We need to take action if we are to remain relevant. In the Netherlands—as undoubtedly in the rest of the world—the big audit firms are investing massive sums of money in data analytics. On a much smaller scale, we at the Netherlands Court of Audit also wish to invest time and money in experimenting with these techniques.

As for block chains and robotics, the spread of block chain technology could clearly have a big impact on our work, perhaps forcing us, ultimately, to reinvent ourselves.

I personally believe that a future in which our reports on central government accounts are replaced by block chain technology on individual transactions is an exciting one. Our audit opinions might ultimately become superfluous. Our roles could shift from giving assurance on data to interpreting data. In a world of big data, that’s where our greatest opportunity may lie.

For audit firms, it is not just a question of whether and how to invest in new audit techniques. It could also be a question of whether and how to change business models and how to continue to attract talented young professionals.

I would be interested to hear from my colleagues in other SAIs about whether they regard digitization as a threat or an opportunity—or perhaps as both. Feel free to contact me at e.vanschoten@rekenkamer.nl.

REFERENCES

1 Netherlands Court of Audit, Open Data Trend Report 2016, The Hague, 2016.

Editor’s Note: This article relates to a previous piece written by Ellen van Schoten that was published in the January 2015 edition of the INTOSAI Journal, which can be found here http://www.intosaijournal.org/highlights/regaining_public_trust_jan2015.html