SAI Latvia Collaborates with Internal Auditors on Oversight

To ensure public sector institutions are functioning properly and at a reasonable cost, the Supreme Audit Institution (SAI) of Latvia is enhancing its collaboration with the internal auditors of these entities. The SAI is currently working directly with internal auditors from national and local government institutions on a financial and a compliance audit.

International Standard of Supreme Audit Institutions (ISSAI) 100 invites SAIs to use the work of internal auditors, and Internal Standard on Auditing (ISA) 610 defines two approaches for doing so: 1) using work that internal auditors have already completed, and 2) obtaining the direct assistance of internal auditors. SAI Latvia has commonly used the first approach, but often encountered situations in which relying on completed work was impossible due to inconsistencies in the internal auditors’ approach or to risks during the audited period. For that reason, SAI Latvia has begun to also use the second approach.

SAI Latvia determined that its audit of the consolidated annual financial statement of the state and local governments was an appropriate place to start, as the audit involved many public sector institutions and would benefit from the cooperation of their internal auditors. Moreover, the audit would provide an opportunity to engage internal auditors across institutions in discussions about the audit’s progress and the best ways to address challenges.

Over the course of this ongoing audit, SAI Latvia has divided up responsibilities with the internal auditors. SAI Latvia is to develop an understanding of the audited area, perform a risk assessment, elaborate an audit approach, manage the methodologies used, ensure quality control, and summarize the results of the work of internal auditors in the audit report. Internal auditors are to perform audit procedures and prepare reports describing their results and providing recommendations to address identified deficiencies.

The work of internal auditors has significantly contributed to the following areas:

- Administration of state fees

- Research expenditures

- Examination of how to improve the drafting process of the consolidated annual financial statement

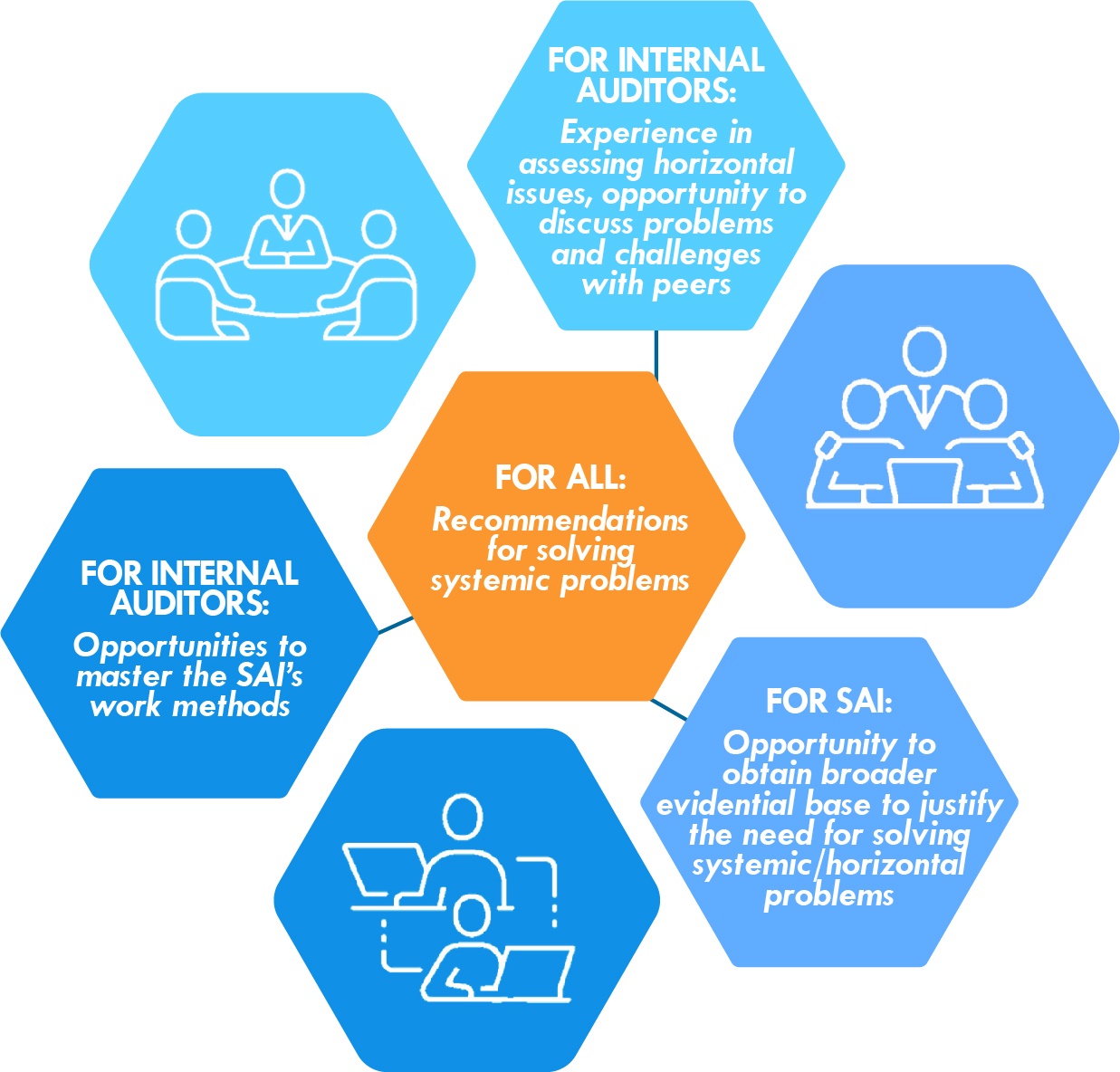

Collaborating on audits benefits both internal auditors and the SAI (see figure). For example, during the COVID-19 pandemic, internal auditors may be better able to obtain evidence—such as accounting data—than SAI auditors.

SAI Latvia is also currently working with internal auditors to assess local governments’ compliance with the Law on the Prevention of Money Laundering and Terrorism and Proliferation Financing, and with the International and Latvian National Sanctions Law. Internal auditors from 15 local governments are auditing these entities’ risk assessments and internal control systems.