by Juan Carlos Proaño Andrade, Auditor with the Office of the Comptroller General of Ecuador

To better administer public resources and fight corruption, the Office of the Comptroller General of Ecuador—the country’s Supreme Audit Institution (SAI)—is working to develop an anonymous hotline through which employees and members of the public can securely report financial fraud at government entities. The hotline will use low-cost mobile devices and open source technology to receive and manage calls.

Fraud—Signs and Detection

Signs of fraud within an organization include:

- Duplicate payments

- Systematic inventory mismatches

- Customer complaints

- Unusual cancellations of debts

- Unreasonable expenses or refunds

- Missing or excess cash

- Unauthorized or incorrectly recorded transactions

- Significant or unusual payments for unspecified services

While there are many ways in which an organization may initially detect signs of fraud, a 2018 study by the Association of Certified Fraud Examiners (ACFE), the world’s largest anti-fraud organization, identified receiving tips as the most common method for doing so.

The ACFE found, for example, of the fraud cases organizations reported between January 2016 and October 2017 in Latin America and the Caribbean, 49 percent were detected through tips. The next most common detection method in the region was internal audits (14 percent), and the method used least was information technology (1 percent).

Worldwide, telephone hotlines were, by far, the most popular way of reporting fraud.

Actively Working to Detect Fraud Minimizes Losses

According to the ACFE study, organizations not actively seeking fraud are more likely to be heavily impacted by it. The ACFE found that fraud detected through a deliberate search tended to be of shorter duration and involve lower median losses than those detected accidentally. Most of the organizations reporting fraud cases (63 percent) had hotlines in place, and fraud losses were 50 percent less at organizations with hotlines than at those without them.

How the Hotline Will Work

In his article on best practices for implementing a hotline, Carlos Ayres (2015) argues that “an effective compliance program should include a mechanism for an organization’s employees and others to report suspected or actual misconduct or violations of company policies confidentially and without fear of reprisal.”

SAI Ecuador is developing its hotline in a manner that protects identities of complainants, many of whom may be employees of the organization. Fifty-three percent of fraud allegations come from employees, and the vast majority of findings result from these tips.

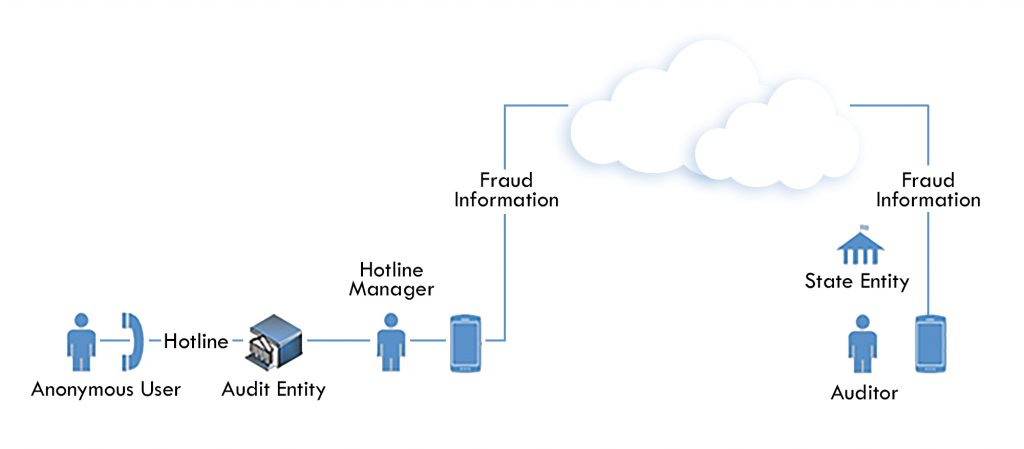

SAI Ecuador will designate a Hotline Manager to receive the calls on a mobile device and establish standard operating procedures—that comply with SAI and national legal frameworks—for investigating fraud allegations.

The hotline will work as follows:

- An anonymous complainant calls to report fraud.

- The conversation between the caller and Hotline Manager is recorded (with the caller’s knowledge). The voice of the caller is electronically masked.

- The Hotline Manager sends the recording to the auditor responsible for the government entity in question or to an internal audit team for analysis.

Hotline Technology

The hotline will use Raspberry PI to receive the phone call from the complainant and transfer the call to the Hotline Manager’s mobile device. An audio recording of the call will be stored in a database in Musical Instrument Digital Interface (MIDI) format.

The Hotline Manager will then use a mobile application developed in Android to send the recording of the call (with the complainant’s voice masked) to the appropriate parties, who will analyze the complaint.

An Effective Way to Fight Fraud

SAI Ecuador’s proposed anonymous fraud reporting hotline is a low-cost, high-impact means to combat corruption that can be emulated in other International Organization of Supreme Audit Institutions (INTOSAI) member countries. Moreover, implementing hotlines like this one may encourage countries to develop laws that promote financial fraud reporting within public entities and protect whistleblowers.

For a full list of references and more information on the technical configuration of SAI Ecuador’s proposed hotline, contact the author at jcproano@contraloria.gob.ec.