Think BIG! — Testing a New Approach for Recommendations

Authors: State Audit Office of the Republic of Latvia; Agnese Jaunzeme, Head of Audit Sector; Silvija Nora Kalniņš, Head of Strategy and International Relations Division

The State Audit Office Law stipulates that the State Audit Office of Latvia (SAI Latvia) has the right to provide recommendations for addressing the deficiencies discovered during the audit, as well as to specify a time limit by which the audited entity shall notify, in writing, that the deficiencies have been resolved. In 2023, SAI Latvia celebrated its centenary, and over time, the State Audit Office has refined its approach in providing recommendations and in facilitating their implementation by the auditees.

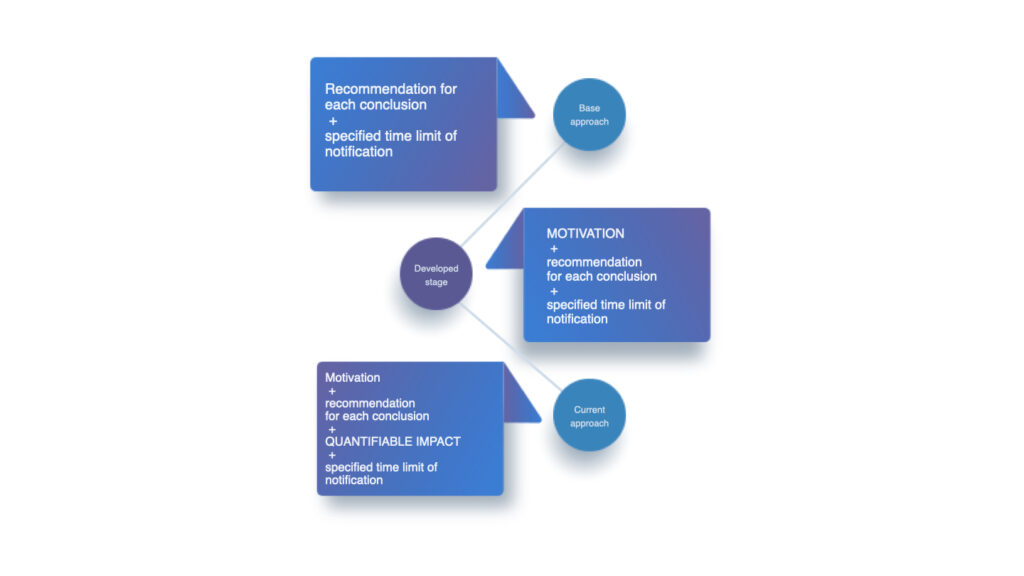

The development process of providing and monitoring the implementation of SAI Latvia’s recommendations can be briefly characterized in the stages reflected in Figure 1, whereby, at the most basic stage, each conclusion set a recommendation and the time limit by which notification on progress of implementing the recommendation was to be made. Later, this approach was elaborated upon by adding motivation to the recommendation and time limit. This was further expanded upon with the development and introduction of a method for the calculation of quantifiable impact of the recommendations of an audit (in its entirety).

The statistics of SAI Latvia for the previous strategic period from 2018 to 2021 indicate commendable results in the field of recommendation management. Specifically, an average of 94% of recommendations were implemented annually, with only 2% of audit department work time dedicated to recommendation management.

Furthermore, SAI Latvia embraced the practice of assessing impact resulting from the implementation of recommendations. The impact has been quantified according to three types – (1) reduction in expenditure, (2) increase in budget revenue and (3) consumer benefits. The calculated financial return (on each Euro invested in SAI Latvia) have been publicly reported as part of audit results within SAI Latvia’s annual report. Table 1 provides data on the financial return in the period since the launch of this approach. It is important to note the communication aspect of this financial return target. Although the calculation of this value is complex, the presentation of the actual financial return is one which can be clearly communicated and understood by the public and key stakeholders. This allows interested parties to have an overall picture of the value brought to the national budget by the work of the SAI.

But the goal cannot be achieved without the support and cooperation of the audited entities. Only by working together – both auditors and audited entities – it is possible to achieve maximum impact.

Table 1. Quantifiable impact indicator values for the period from 2018 to 2023.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Number of implemented recommendations | 36 | 19 | 25 | 34 | 30 | 20 |

| Planned financial return | 1:1,5 | 1:1,7 | 1:1,9 | 1:2 | 1:2 | 1:2 |

| Actual financial return | 1:4 | 1:4,6 | 1:4 | 1:4,4 | 1:5,6 | 1:3 |

| Total quantifiable impact, in mil. Euros | 16,15 | 26,80 | 18,95 | 16,05 | 29,91 | 15,29 |

SAI Latvia has remained vigilant despite the noteworthy performance in the rate of implemented recommendations by auditees. Taking a step further, through research on theory of change, performance indicators and looking at the success of methods in other SAIs, most notably SAI Lithuania, SAI Latvia has endeavored to improve its approach to providing recommendations in accordance with best practices. Of the four strategic objectives outlined in SAI Latvia’s strategy for 2022-2025, two are aligned to address audit recommendations and their impact:

- Strategic objective one focuses on the promotion of sound public spending to maximize benefits to the public; and,

- Strategic objective two looks to increase the impact of the work of the State Audit Office for the public benefit.

Thus, as part of the 2022-2025 Strategy, SAI Latvia has devised a conceptual solution and is piloting it in performance audits. This solution entails focusing the State Audit Office’s work and that of the audited entity towards tangible, measurable change, instead of fragmented processes, actions, or activities.

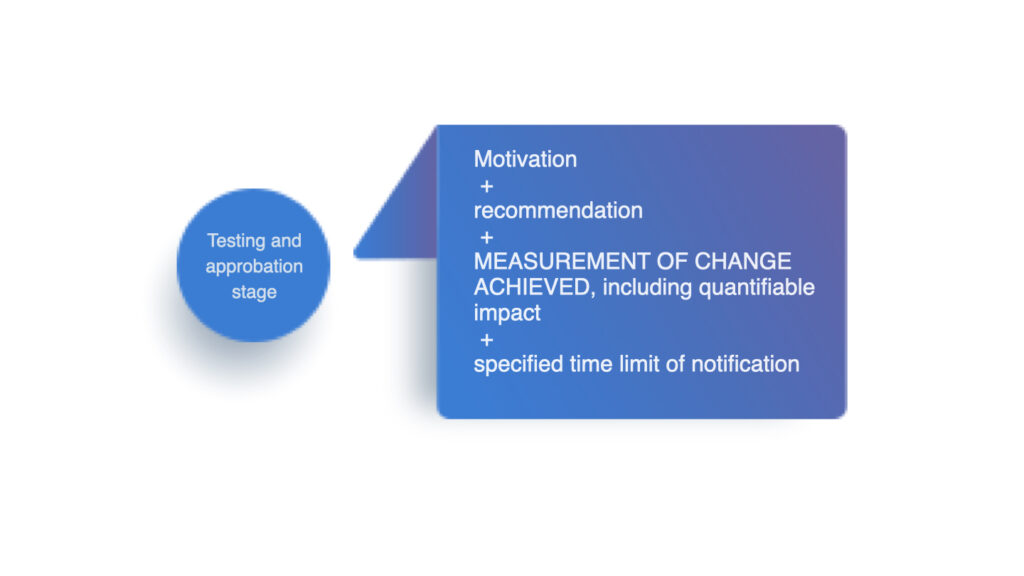

Through this approach illustrated in Figure 2, the positive change achieved from the implementation of recommendations will be clear and easily communicated to the public.

The aim of the concept is to introduce within the process of recommendation management a new principle: A recommendation is considered implemented when the implementation of the required actions results in positive change and contributes to securing benefits to the public as much as possible (Table 2).

Table 2. The conceptual change illustration.

| Previous practice: Recommendation implemented = actions taken (deficiencies resolved) | The conceptual change:Recommendation implemented = actions taken (deficiencies resolved) + positive change achieved |

| The State Audit Office confirmed that the audited entity has taken measures to ensure the implementation of the recommendation, thus acknowledging the recommendation as implemented. | By acknowledging the implementation of the recommendation and the subsequent change, the State Audit Office bestows a “seal of confidence”, signifying confirmation that the actions have yielded the intended result. |

Source: SAI Latvia

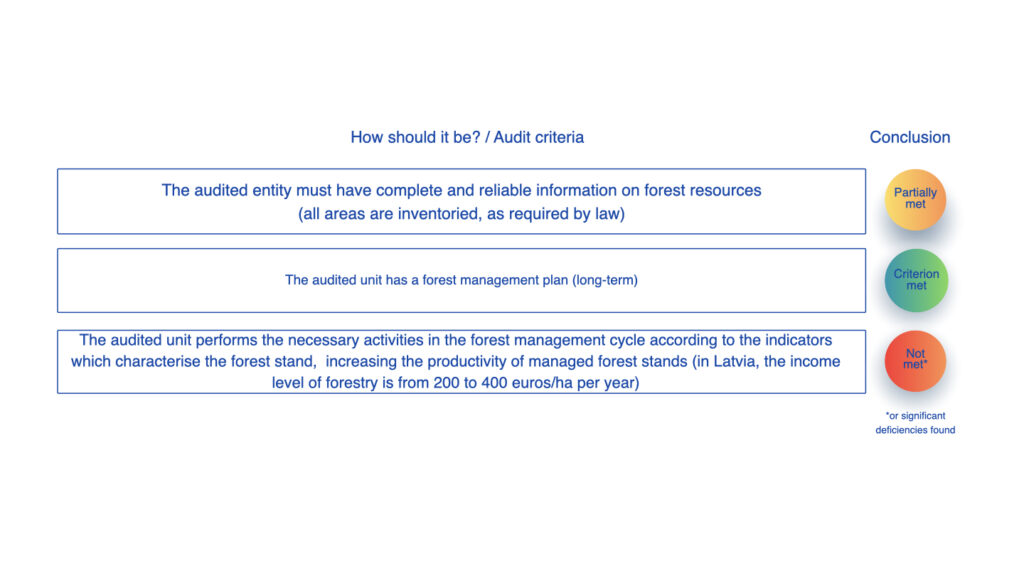

This conceptual solution has already been tested in several compliance and performance audits. Figure 3 is a brief presentation from the performance audit “Municipal Forests – non-efficient utilization of public resources”. The objective of the performance audit was to assess whether the actions of the audited entities regarding their forest resources are effective and efficient. During the audit planning phase, auditors set out criteria describing “how should it be?” (the auditee is informed of the criteria), and after obtaining audit evidence, auditors carried out an evaluation comparing “what the situation is” against “how should it be”.

In the audit report, the auditors provide recommendations to facilitate the achievement of the criteria recognized in the audit as partially met or not met. Table 3 provides information on an example where the criterion is assessed as not met in the audit.

Table 3. Example of recommendation and indicators to be met.

| Recommendation provided | Changes | Responsible entity to implement recommendation | Deadline for implementation of the recommendation | ||||

| Indicator | Initial value | Target value | |||||

| Perform the necessary actions within the forest management cycle according to the indicators characterizing the forest stands, thereby increasing the efficiency of managed forest stands, thus striving for maximum future value | Level of forestry income of the audited entity*, euro/year | Initial value to be calculated (no such information was provided during the audit) | With a growing trend (In Latvia forestry income is between 200 and 400 euros/ha per year) | Name of the entity | The deadline for the implementation of the recommendation shall be determined by the audited entity by the deadline determined for the implementation of all actions | ||

| Managed forest area, ha | 5067,56 | Increase by at least 25 % | |||||

| Actions specified by the audited entity | Name of the audited entity (responsible for the implementation of the actions) | Deadline specified by the audited entity | |||||

Source: SAI Latvia

Accordingly, this form containing the recommendations, along with the draft audit report, is submitted to the audited entity for review and for the entity to specify actions to be undertaken as part of the process for the implementation of the recommendations.

The core idea of the proposed concept is as follows:

During the audit planning phase, the auditor establishes criteria for “how should it be?”. After gathering audit evidence, the auditor determines that processes within the audited entity are not aligned with the expected performance.

Consequently, recommendations are provided. During the implementation period, the audited entity is granted additional time to enhance its performance and improve its performance indicators by focusing on achieving the target value of the change, rather than formally implementing various actions one after another.

Since the Parliament requests SAI Latvia to report on the progress of the implementation of audit recommendations, it is crucial to emphasize that, while retaining the explanation of the solution envisaged in the concept, the audited entity will report to the State Audit Office on the progress of the implementation of all recommendations provided during the next five-year-period (irrespective of the deadline for implementation of the recommendation).

Following this timeframe, the State Audit Office will evaluate the achieved changes and determine the implementation status (implemented, not implemented, partially implemented). After this deadline, the State Audit Office will no longer continue monitoring the actions of the audited entity related to the audit in question.

The State Audit Office, assessing potential outcomes from the implementation of recommendations and taking into account the Parliament’s suggestions, may decide against assessing the progress of the audited entity’s activities. Instead, it may opt for a follow-up audit to evaluate the positive changes achieved.

With this conceptual solution and its application, together with the calculation of financial return, SAI Latvia aims to adhere to the necessity of clearly demonstrating both quantitative and qualitative change resulting from each audit. This approach will serve as an additional incentive for auditees to focus more on achieving tangible, measurable change, thereby maximizing benefits for society through collaborative efforts.

For further information, please contact SAI Latvia by email: pasts@lrvk.gov.lv