Author: Elizabeth M. Mixon, U.S. GAO

The Government Accountability Office’s (GAO) work routinely generates recommendations for improving the efficiency and effectiveness of government programs, resulting in measurable savings and improvements. Since fiscal year (FY) 2002, GAO’s work has resulted in about $1.38 trillion in financial benefits and over 28,000 program and operational benefits that have helped change laws, improve public safety and other services, and promote better management throughout government. In FY 2023 alone, GAO’s work yielded $70.4 billion in financial benefits—a return of about $84 for every dollar invested in GAO. GAO also identified 1,220 other benefits—those that cannot be measured in dollars but led to program and operational improvements across the government. Examples of recent accomplishments include:

- Returning Billions of Unused COVID-19 Relief Funding. Since March 2020, Congress has provided over $4.6 trillion to help the nation respond to and recover from the COVID-19 pandemic. In February 2023, we reported that federal agencies had not used over $90.5 billion of these funds as of January 2023. We provided Congress monthly updates about specific agency accounts with unused funds. In June 2023, Congress used this information when it passed the Fiscal Responsibility Act of 2023, which required certain agencies to return about $27.1 billion of these unused funds to the Treasury. (GAO-23-106647)

- Improving Oversight of the U.S. Department of Veterans Affairs (VA)’s Community Living Centers: VA provides care to nearly 9,000 veterans per day in 134 VA-operated nursing homes—called community living centers. In 2021, we recommended that VA strengthen its approach to overseeing care and addressing resident complaints at these centers. In FY 2023, VA took a number of steps to do so. For example, VA improved how it identifies these centers in the electronic system it uses to monitor patient safety. This will help VA reliably locate where patient safety issues are occurring and improve oversight of these centers. (GAO-22-105142, GAO-22-104027)

About 60 percent of our products contain recommendations, and since 2014, we have issued an average of almost 1,300 recommendations each year. The Congress and management of the audited agencies have discretion on whether to implement our recommendations, and they have implemented an average of about 77 percent of our recommendations over the last 10 years. We focus attention on following up on our recommendations to help ensure that they are implemented effectively and in a timely manner.

Working with the Congress

Congress plays a key role in providing oversight and maintaining focus on our recommendations to ensure they are implemented and produce desired results. In addition to reporting on the status of recommendations to Congress, we engage with Congress on strategies for further addressing our recommendations. These strategies include incorporating our recommendations into legislation. Additionally, Congress can use its budget, appropriations, and oversight processes to incentivize agencies to act on our recommendations and monitor their progress. For example, Congress can hold hearings focused on implementing GAO’s recommendations, withhold funds when appropriate, or take other actions to provide incentives to act. Moreover, Congress could follow up during the appropriations process and request periodic updates.

Working with Agencies

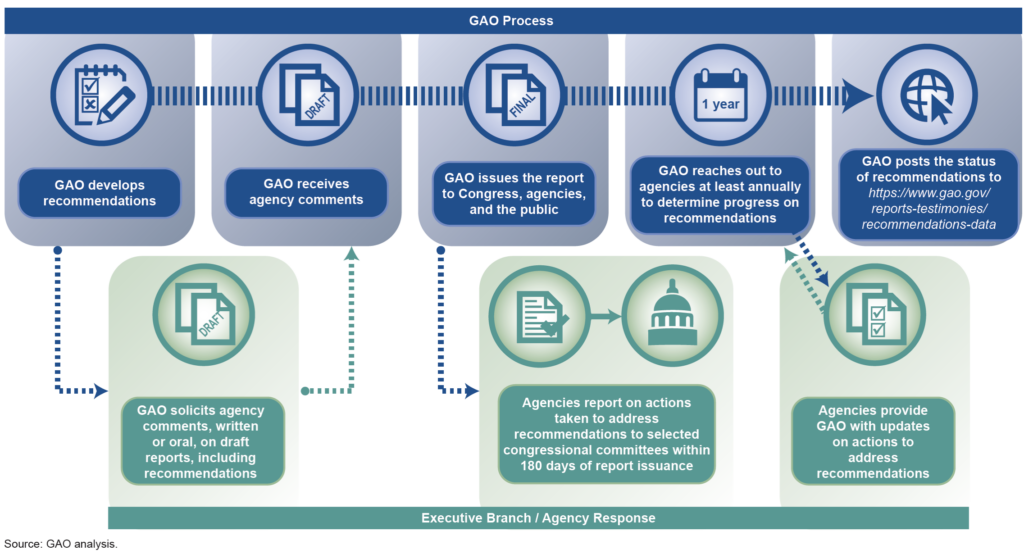

We engage with agencies on an on-going basis about opportunities to improve program performance during and after the course of our audit work. By communicating with agency officials throughout the audit process, deficiencies identified in our work can be immediately addressed, without waiting for a report to be issued. The figure below highlights the mechanisms we use emphasize our recommendations.

Agency Review and Comment. We provide agency officials with an opportunity to review and comment on a draft of our report, including the recommendations, before it is issued in most instances. Through this process, agency officials may indicate steps that they are taking or planning to take to address the recommendations, and we reflect these steps in the report as appropriate. If the officials do not agree with our recommendations, they can provide the rationale for any disagreement with our report findings. After receiving the agency’s comments, we consider their substance, revise the draft product as appropriate, and present the agency’s comments in the final report.

Agency Reporting to Congress. When we issue a report containing recommendations to the head of an agency, that official is required by statue to submit a written statement of the actions taken by the agency on our recommendations to Congress not later than 180 days after the date of the report.

Outreach to Agencies. At least once a year we reach out to agencies to determine the extent to which they have implemented our recommendations and if benefits can be attributed to our work. Throughout this process, our leadership works with agency officials to bring attention to our recommendations. Our analysts also update the status of recommendations when conducting related work on a particular topic.

Report on Recommendation Status. Updates to recommendations are posted to a public database (Recommendations Database | U.S. GAO), which Congress can use to prepare for oversight hearings and budget deliberations. In addition, we update the status of recommendations when preparing testimony for Congress and as part of ongoing related work. Continued attention to recommendations is important because failure to implement our prior recommendations is often a major factor that leads to issues escalating to the point where they become high-risk.

Reporting on Open Recommendations

In addition to these processes, we highlight critical unimplemented recommendations that we believe warrant attention by Congress and agencies in our signature reports, including our biennial high-risk report, our annual fragmentation, overlap, and duplication and fiscal health reports, and in priority recommendation letters to agency heads.

High-Risk Report. We issue biennial reports updating our High-Risk List, which identifies government operations with vulnerabilities to fraud, waste, abuse, and mismanagement, or in need of transformation. We meet regularly with the Office of Management and Budget and agency Chief Financial Officers to discuss progress agencies are making to address these high-risk issues. Most recently, in April 2023, we reported that agencies need to address hundreds of our open recommendations to bring about lasting solutions to 37 high-risk areas, and that legislation is needed in some cases.(1)

Fragmentation, Overlap, and Duplication Report. Each year we report on opportunities for agencies and Congress to reduce fragmentation, overlap, and duplication in federal programs, including options for agencies to save money and increase revenue. As of April 2023, Congress and agencies had fully or partially addressed 1,383 (73 percent) of the 1,885 matters and recommendations; of these, they had fully addressed 1,239 and partially addressed 144.(2)

Fiscal Health Report. Each year, we issue an annual fiscal health report that examines the current fiscal condition of the federal government and its future fiscal path, absent policy changes in revenue and program spending. We have previously reported that the nation is on an unsustainable fiscal path caused by a structural imbalance between spending and revenue.(3) Implementing our recommendations can help reduce the deficit, though these actions alone are not sufficient to address the nation’s serious fiscal imbalance. Since 2017, we have suggested that Congress develop a plan to place the government on a sustainable long-term fiscal path—where government spending and revenue result in a stable or declining ratio of debt held by the public to GDP over the long term.

Priority recommendation Letters. Since 2015, we have sent annual priority recommendation letters to heads of departments or agencies highlighting recommendations that could save large amounts of money; improve congressional or executive branch decision-making on major issues; eliminate mismanagement, fraud, and abuse; or ensure that programs comply with laws and that funds are spent legally.(4) These letters do not include all our open recommendations but highlight recommendations that we believe warrant priority attention from agency heads.

As the fiscal pressures facing government continue, so too does the need for Congress and agencies to improve the efficiency and effectiveness of government programs and activities. Our recommendations provide a significant opportunity to improve the government’s fiscal position, better serve the public, and make government programs more efficient and effective.